UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |||

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| x | Definitive Proxy Statement | |||

| ¨ | Definitive Additional Materials | |||

| ¨ | Soliciting Material under Rule 14a-12 | |||

CCA Industries, Inc. | ||||

| (Name of Registrant as Specified in Its Charter) | ||||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| x | No fee required | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

|

| ||||

| (2) | Aggregate number of securities to which transaction applies:

| |||

|

| ||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

|

| ||||

| (4) | Proposed maximum aggregate value of transaction:

| |||

|

| ||||

| (5) | Total fee paid: | |||

|

| ||||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

|

| ||||

| (2) | Form, Schedule or Registration Statement No.:

| |||

|

| ||||

| (3) | Filing Party:

| |||

|

| ||||

| (4) | Date Filed:

| |||

|

| ||||

Letter to Our Shareholders

May 2012

Dear Shareholder,

We are pleased to report to our shareholders that fiscal 2011 was a year in which we returned to profitability. The company continued to remain bank debt free with an excellent current ratio of 3.4 to 1 of current assets to current liabilities.

In the fourth quarter of 2011 CCA launched an exciting new line of nail color products under the brand name of Nutra Nail Gel Perfect 5 Minute Gel.

Nutra Nail Gel Perfect 5 Minute Gel Colors is a gel color nail color line that can be conveniently applied at home, providing salon like gel colors that do not need UV or LED lights to dry them as is used in nail salons. In fact, Gel Perfect colors dry “rock solid” in only 5 minutes – a remarkable change for users of regular nail polish who are used to dings, smears and marks if they don’t allow their nail polish to completely dry. Unlike salon gel colors that are difficult and time consuming to remove, Gel Perfect can be removed using Nutra Nail’s No Mess Express Patent Pending Remover which removes Gel Perfect in only 2 minutes! And the No Mess Express nail polish remover even works great on any nail polish offering additional sales potential. Gel Perfect was initially sold into over 20,000 retail stores led by Wal-Mart, Walgreens, CVS, Rite Aid, Ulta and Harmon stores. There is even greater growth potential for Gel Perfect as the distribution continues to expand in fiscal 2012. As a brand, Gel Perfect provides CCA a wonderful opportunity for evolution into a complete cosmetic line.

In 2011, we incurred some difficulty in the stability of certain of our oral care products. New reformulations have indicated those stability problems have been cured. We have made additions to our diet and skin care line of products. We have also done some test marketing utilizing new strategies for our core brands, which have provided results that indicate we have opportunities for significant growth in fiscal 2012.

We believe our company’s future has never been better. As a result, we have continued our consecutive quarterly dividend payments into the first quarter fiscal 2012.

The company’s management, its employees and its Board of Directors remain committed, as ever, to increasing shareholder value in 2012 and the years ahead. We feel confident that our new strategic direction and focus on core brands will result in the achievement of that goal.

| Sincerely, |

| /s/ Dunnan D. Edell |

| Dunnan D. Edell President and Chief Executive Officer |

| /s/ Stanley Kreitman |

| Stanley Kreitman Chairman of the Board |

CCA INDUSTRIES, INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

JULY 10, 2012

TO THE SHAREHOLDERS:

NOTICE IS HEREBY GIVEN that the Annual Meeting of the Shareholders of CCA INDUSTRIES, INC., a Delaware corporation (hereinafter, the “Company”) will be held on July 10, 2012, at 2:00 p.m., at the offices of the Company, 200 Murray Hill Parkway, East Rutherford, New Jersey 07073, for the following purposes:

Management Proposals

| 1. | To elect as directors the seven nominees named in the attached Proxy Statement (four of whom are to be elected by the Class A Common Stock Shareholders and three of whom are to be elected by Common Stock Shareholders). |

| 2. | To ratify the appointment of BDO USA, LLP (“BDO”) as the Company’s independent certified public accountants for the fiscal year ending November 30, 2012. |

Such other business, if any, as may properly come before the meeting or any adjournment thereof, shall also be considered.

The identified proposals are more fully described, and related information is presented, in the Proxy Statement accompanying this Notice.

Only shareholders of record at the close of business on May 14, 2012 are entitled to notice of the meeting, and to vote at the meeting and at any continuation or adjournment thereof.

Your vote is very important. All shareholders are requested to be present at the meeting in person or by proxy so that a quorum may be ensured. Alternatively, you may vote via the telephone, internet, or if preferred, you may request a proxy card.

| BY ORDER OF THE BOARD OF DIRECTORS | ||||||

| Stanley Kreitman | ||||||

| Chairman of the Board | ||||||

East Rutherford NJ

May 29, 2012

WHETHER OR NOT YOU PLAN TO ATTEND THIS MEETING, YOU ARE URGED TO EITHER VOTE BY TELEPHONE OR INTERNET, OR BY COMPLETING, SIGNING AND RETURNING THE PROXY CARD IF YOU REQUESTED ONE. NO POSTAGE NEED BE AFFIXED IF MAILED IN THE UNITED STATES AND IN THE ENVELOPE PROVIDED WITH THE PROXY CARD.

1

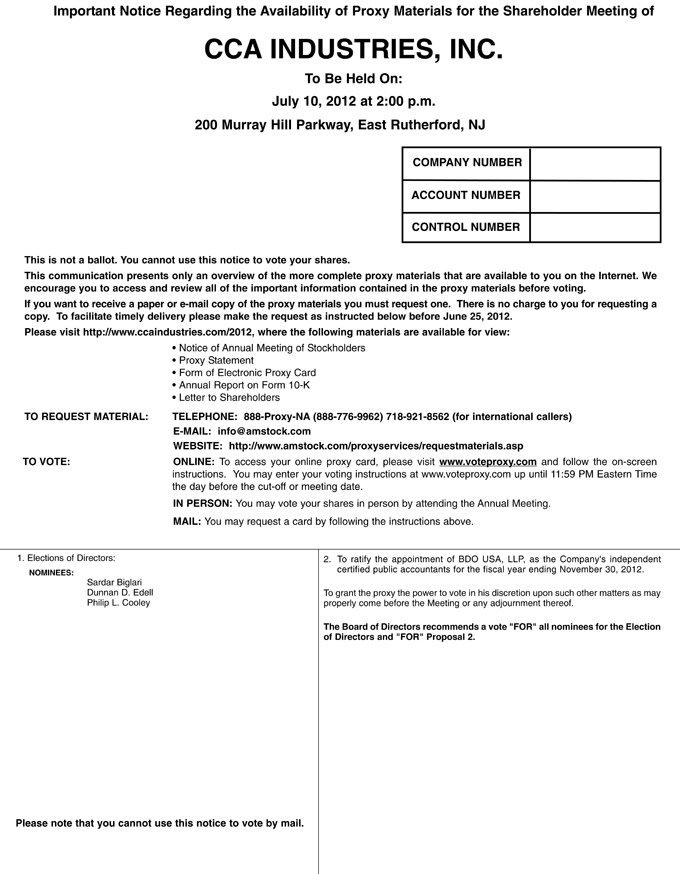

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON JULY 10, 2012.

Our Notice of Annual Meeting, Proxy Statement, Letter to Shareholders and Annual Report are available online at:

www.ccaindustries.com/2012

2

CCA INDUSTRIES, INC.

200 Murray Hill Parkway

East Rutherford, New Jersey 07073

www.ccaindustries.com

PROXY STATEMENT

The enclosed proxy is solicited on behalf of the Board of Directors of CCA INDUSTRIES, INC., a Delaware corporation (hereinafter, the “Company”), for use at its Annual Meeting of Shareholders to be held on July 10, 2012, at 2:00 p.m., at the Company’s offices, 200 Murray Hill Parkway, East Rutherford, New Jersey 07073 (hereinafter the “Annual Meeting”). Shareholders of record on May 14, 2012 will be entitled to vote. The Company has made the proxy materials available to the shareholders of record at www.ccaindustries.com/2012 beginning on May 29, 2012 and is first mailing such materials to the shareholders that requested printed copies of such materials on or about May 29, 2012.

NOTICE ONLY DELIVERY METHOD

The Company has adopted the Securities and Exchange Commission “Notice Only” delivery method of distributing the Proxy Statement and Annual Report to shareholders, which allows the Company to furnish its proxy materials over the internet to its shareholders instead of mailing paper copies of those materials to each shareholder. Therefore, on or about May 29, 2012, the Company is mailing a Notice of Internet Availability of Proxy Materials (“E-Notice”) to the shareholders which contains information regarding the availability of proxy materials, a letter to the shareholders and the Company’s annual report on Form 10-K for the 2011 fiscal year. The E-Notice includes information on how to vote online. Information can also be found in the investor section of the Company’s website, www.ccaindustries.com/2012, and at www.voteproxy.com. Shareholders may also request a printed copy of the proxy materials by either calling 888-PROXY-NA (888-776-9962) or 1-718-921-8562 (for international callers), sending an e-mail to info@amstock.com or going online to the website: http://www.amstock.com/proxyservices/requestmaterials.asp. The E-Notice is not a proxy card and cannot be used to vote your shares.

IMPORTANT VOTING INFORMATION

Abstentions and Broker Non-Votes. Abstentions and broker non-votes are counted for purposes of determining the presence or absence of a quorum for the transaction of business. Abstentions occur when shareholders are present at the Annual Meeting but choose to withhold their vote for any of the matters upon which the shareholders are voting. “Broker non-votes” occur when other holders of record (such as banks and brokers) that hold shares on behalf of beneficial owners do not receive voting instructions from the beneficial owners before the Annual Meeting, and do not have discretionary authority to vote those shares if they do not receive timely instructions from the beneficial owners. At the Annual Meeting, brokers will not have discretionary authority to vote on Proposal No. 1, Election Of Directors, in the absence of timely instructions for the beneficial owners; however brokers will have discretionary authority to vote on Proposal No. 2, Ratification Of Appointment Of Auditors. As a consequence, there will be no broker non-votes with regard to Proposal No. 2.

You may vote “FOR” or “WITHHOLD AUTHORITY” for each director nominee. If you vote “WITHHOLD AUTHORITY,” your vote will be counted for purposes of determining the presence of a quorum. You may vote “FOR”, “AGAINST” OR “ABSTAIN” on the Company’s proposal to ratify the selection of our independent registered public accounting firm.

3

VOTING

The Company, as provided in and by its Certificate of Incorporation, has two authorized classes of common stock, denominated Common Stock and Class A Common Stock, and one authorized class of preferred stock, denominated Preferred Stock.

As of May 14, 2012, the record date for the Annual Meeting, there were 6,086,740 shares of Common Stock and 967,702 shares of Class A Common Stock outstanding. There are no outstanding shares of Preferred Stock.

Holders of Common Stock and holders of Class A Common Stock are entitled to one vote for each share of stock held, and the voting and other rights of each class are equivalent, except in respect to the election of directors. The Class A Common Stock shareholders have the right to elect four directors and the Common Stock shareholders have the right to elect three directors.

A quorum, counting proxies and shares represented in person, is necessary to the voting upon proposals proposed by management, and other business that may properly come before the Annual Meeting. The presence at the meeting, in person or by proxy, of the holders of a majority of the outstanding shares of Common Stock is a quorum for the election of directors to be elected by the holders of Common Stock, and the presence at the meeting, in person or by proxy, of the holders of a majority of the outstanding shares of Class A Common Stock is a quorum for the election of directors to be elected by holders of Class A Common Stock. For matters on which the shareholders vote together as a single class, the presence at the meeting, in person or by proxy, of the holders of a majority of all outstanding shares constitutes a quorum.

Election of directors is by a plurality vote of the respective class. Ratification of the appointment of the Company’s independent certified public accountants requires a majority of the votes cast on the matter.

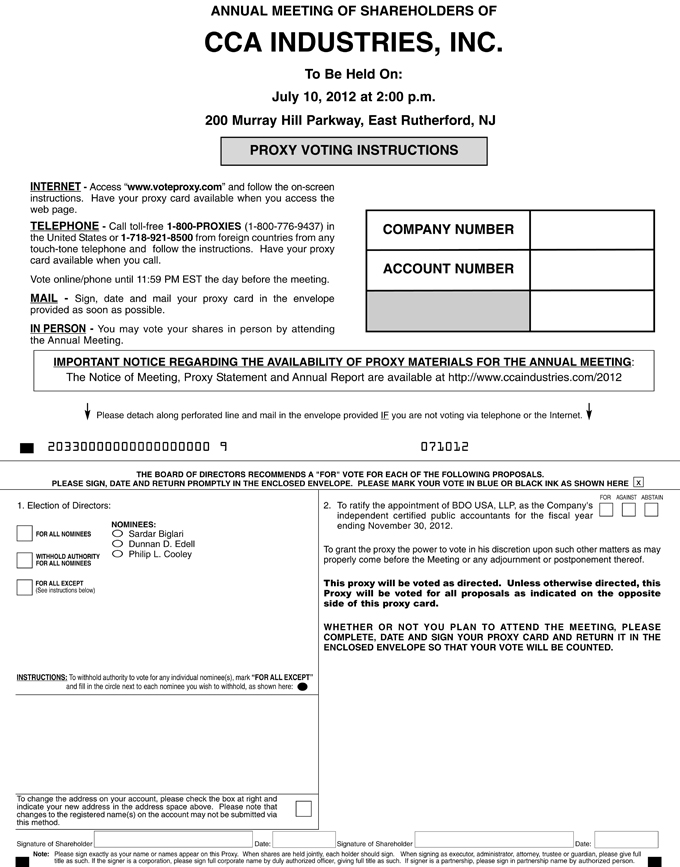

How to Vote:

You may vote in person at the Annual Meeting, by telephone, internet or by proxy. Even if you plan to attend the Annual Meeting, we encourage you to vote by following the internet voting instructions on the E-Notice in advance of the Annual Meeting or, if you request a proxy card to be sent to you, by completing, signing and returning your proxy card.

In Person:

If you plan to attend the Annual Meeting and wish to vote in person, we will give you a ballot at the Annual Meeting. If your shares are held in the name of a broker or other nominee, we will allow you to attend the Annual Meeting upon presentation from the brokerage company an account statement, letter or other evidence satisfactory to us of your beneficial ownership of the shares. However, in order to vote in person at the meeting, you must obtain a proxy from your broker or other nominee, and bring that proxy to the meeting.

Internet:

To vote online, go to http://www.voteproxy.com as set forth on the E-Notice and follow the on-screen instructions. You will need the control number on your E-Notice to vote online. You may vote online until 11:59PM EST the day before the meeting.

Telephone:

To vote by telephone, call toll-free 1-800-776-9437 in the United States or 1-718-921-8500 from foreign countries from any touch-tone telephone and follow the instructions. You will need the control number on your E-Notice to vote by telephone. You may vote by telephone until 11:59PM EST the day before the meeting.

4

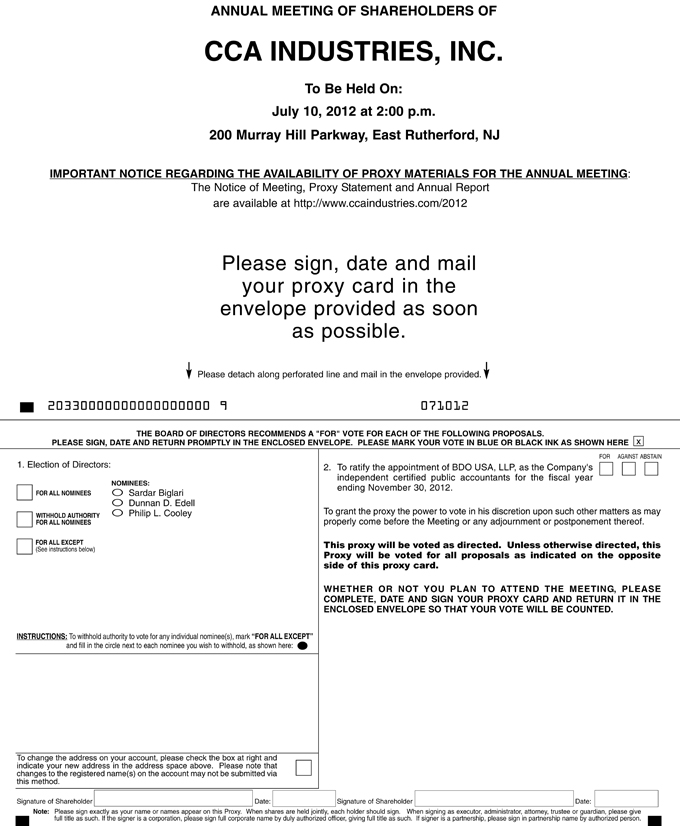

Proxy:

If you have requested that a proxy card be sent to you, please mail your completed, signed and dated proxy card in the enclosed postage-paid return envelope as soon as possible.

You have the power to revoke your proxy at any time before its exercise. Thus, it may be revoked prior to its exercise by the filing of an instrument of revocation, or a duly executed proxy bearing a later date, with the Secretary of the Company at the Company’s principal executive office. You can also revoke a filed proxy by attending the meeting and voting in person.

5

SECURITY OWNERSHIP OF MANAGEMENT AND OTHER CERTAIN BENEFICIAL OWNERS

The following table sets forth certain information regarding the ownership of the Company’s Common Stock, Class A Common Stock and beneficial ownership of all shares outstanding as of May 21, 2012 by (i) each of the directors and director nominees named herein, (ii) each of the named executive officers listed in the summary compensation table and (iii) all current officers and directors as a group. Other than as noted below, the Company is not aware of any person, who, or as group which, beneficially owns more than five percent (5%) of any class of the Company’s equity securities as of May 21, 2012. Unless otherwise indicated, each of the shareholders has sole voting and investment power with respect to the shares owned (subject to community property laws, where applicable), and is the beneficial owner of them.

| Beneficial Ownership of Equity Securities |

||||||||||||||||||||

| Ownership | Ownership | Ownership | ||||||||||||||||||

| Number of Shares Owned | Percentage of | Percentage of | Percentage of | |||||||||||||||||

|

|

|

|||||||||||||||||||

| Class A | Common Stock | Class A Stock | All Shares | |||||||||||||||||

| Name |

Common Stock | Common Stock | Outstanding (2) | Outstanding (1) | Outstanding | |||||||||||||||

| David Edell |

146,609 | 484,615 | 2.4 | % | 50.1 | % | 8.9 | % | ||||||||||||

| Ira Berman |

160,533 | 483,087 | 2.6 | % | 49.9 | % | 9.1 | % | ||||||||||||

| Sardar Biglari (3) |

776,259 | — | 12.8 | % | — | 11.0 | % | |||||||||||||

| Philip L. Cooley |

— | — | — | — | — | |||||||||||||||

| Stanley Kreitman |

15,000 | — | * | — | * | |||||||||||||||

| Robert Lage |

— | — | — | — | — | |||||||||||||||

| James P. Mastrian |

— | — | — | — | — | |||||||||||||||

| Jack Polak |

53,254 | — | * | — | * | |||||||||||||||

| Dunnan D. Edell |

77,158 | — | 1.3 | % | — | 1.1 | % | |||||||||||||

| Drew Edell |

98,108 | — | 1.6 | % | — | 1.4 | % | |||||||||||||

| Stephen A. Heit |

2,461 | — | * | — | * | |||||||||||||||

| Officers & Directors As a Group (9 persons) |

1,115,559 | 484,615 | 18.3 | % | 50.1 | % | 22.7 | % | ||||||||||||

| * | Represents less than one percent (1%) of the outstanding shares of the class. |

| (1) | David Edell and Ira Berman own 100% of the outstanding shares of Class A Common Stock. |

| (2) | Ira Berman was a director and Chairman of the Board, and Jack Polak was a director until August 4, 2011, when they did not stand for re-election at the annual meeting of shareholders. Dunnan Edell is an officer and director. Messrs. Stephen Heit and Drew Edell are officers. Messrs. Biglari, Cooley, Kreitman, Lage, and Mastrian are independent, outside directors and David Edell is a director. Messrs. Biglari and Cooley were elected directors at the annual meeting of shareholders held on August 4, 2011. |

| (3) | The amount reported includes 388,130 shares held by Biglari Holdings Inc. as of May 21, 2012. Sardar Biglari is the Chairman and Chief Executive Officer of Biglari Holdings Inc. and has investment discretion over the securities owned by Biglari Holdings Inc. By virtue of this relationship, Sardar Biglari may be deemed to beneficially own the 388,130 shares owned directly by Biglari Holdings Inc. Sardar Biglari expressly disclaims beneficial ownership of such shares except to the extent of his pecuniary interest therein. The amount reported also includes 388,129 shares held by the The Lion Fund, L.P. (“The Lion Fund”) as of May 21, 2012. Biglari Capital Corp. (“BCC”) is the general partner of The Lion Fund and is a wholly-owned subsidiary of Biglari Holdings Inc. Sardar Biglari is the Chairman and Chief Executive Officer of each of BCC and Biglari Holdings Inc., and has investment discretion over the securities owned by The Lion Fund. By virtue of these relationships, BCC, Biglari Holdings Inc. and Sardar Biglari may be deemed to beneficially own the 388,129 shares owned directly by The Lion Fund. Each of BCC, Biglari Holdings Inc. and Sardar Biglari expressly and respectively disclaims beneficial ownership of such shares except to the extent of their respective pecuniary interest therein. The principal business address of each of Biglari Holdings Inc., Sardar Biglari, BCC and The Lion Fund is 17802 IH 10 West, Suite 400, San Antonio, Texas 78257. |

6

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires our executive officers and directors and beneficial owners of more than ten percent of the Company’s equity securities to file reports regarding ownership of the Company’s equity securities with the SEC, and to furnish the Company with copies of all such filings. Based solely on a review of these filings, the Company believes that all filings were timely made in fiscal 2011, except for one Form 4 for Stephen Heit that was filed late on February 17, 2012 to report five small acquisitions of common stock pursuant to a Rule 10b5-1 dividend reinvestment plan.

EXECUTIVE OFFICERS OF THE COMPANY

The following individuals are the executive officers of the Company:

President and Chief Executive Officer: Dunnan D. Edell, 56 years old, has served as the Company’s President and Chief Executive Officer since the beginning of the 2011 fiscal year. Prior to that, Mr. Edell served as President and Chief Operating Officer beginning in fiscal 2003. Mr. Edell joined the Company in 1984, was appointed Divisional Vice-President in 1986. He has been a director since 1994. He is a graduate of the George Washington University. He was employed by Alleghany Pharmacal Corporation from 1982 to 1984 and by Hazel Bishop from 1977 to 1981. Mr. Edell is the son of David Edell, who was the Chief Executive Officer until end of the fiscal 2010 year, and now serves as a consultant to the Company, and the brother of Drew Edell, who is the Company’s Executive Vice President of Product Development and Production.

Executive Vice President and Chief Financial Officer: Stephen Heit, 57 years old, joined CCA in May 2005 as Executive Vice President – Operations, and was appointed Chief Financial Officer in March 2006. Prior to that he was Vice President – Business Strategies for Del Laboratories, Inc., a consumer products company that was listed on the American stock exchange, from 2003 to 2005. Mr. Heit served as President of AM Cosmetics, Inc. from 2001 to 2003, as Chief Financial Officer from 1998 to 2003, and Corporate Secretary to the Board of Directors from 1999 to 2003. From 1987 to 1997 he was the Chief Financial Officer of Pavion Limited, and also served on the Board of Directors. He also served as a Director of Loeb House, Inc., a non-profit organization serving mentally handicapped adults from 1987 to 1995, and Director of Nyack Hospital Foundation from 1993 to 1995. He received a Bachelor of Science from Dominican College in 1976, with additional graduate work in professional accounting at Fordham University, and an MBA in accounting from the University of Connecticut School of Business.

Executive Vice President – Product Development and Production, Corporate Secretary: Drew Edell, 54 years old, is a graduate of Pratt Institute, where he received a Bachelor’s degree in Industrial Design. Mr. Edell has been serving as Executive Vice President – Product Development and Production, and became Corporate Secretary, effective December 1, 2010. He joined the Company in 1983, and in 1985, he was appointed Vice President of Product Development and Production.

7

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table summarizes compensation earned in the 2011, 2010 and 2009 fiscal years by the Chief Executive Officer, Chief Financial Officer and Executive Vice President, Product Development and Production and Corporate Secretary (the “named executive officers”).

Summary Compensation Table

| Name and Principal Position |

Year | Salary ($) |

Bonus ($) (1) |

All Other Compensation ($) (2) |

Total ($) |

|||||||||||||||

| Dunnan D. Edell |

2011 | 350,000 | 100,000 | 22,735 | 472,735 | |||||||||||||||

| President, Chief |

2010 | 350,000 | 64,000 | 17,977 | 431,977 | |||||||||||||||

| Executive Officer |

2009 | 350,000 | 96,000 | 17,909 | 463,909 | |||||||||||||||

| Stephen A. Heit |

2011 | 250,000 | 40,000 | 21,310 | 311,310 | |||||||||||||||

| Chief Financial Officer, |

2010 | 250,000 | 23,333 | 12,709 | 286,042 | |||||||||||||||

| Executive Vice President, Treasurer |

2009 | 250,000 | 35,000 | 10,370 | 295,370 | |||||||||||||||

| Drew Edell |

2011 | 275,000 | 40,000 | 21,703 | 336,703 | |||||||||||||||

| Executive Vice |

2010 | 275,000 | 32,000 | 17,140 | 324,140 | |||||||||||||||

| President, Product |

2009 | 275,000 | 48,000 | 12,620 | 335,620 | |||||||||||||||

| Development & Production, Corporate Secretary |

||||||||||||||||||||

| (1) | Bonus amounts represent amounts earned in each respective fiscal year, not necessarily paid in each year. |

| (2) | Includes the personal-use value of Company-leased automobiles, the value of Company-provided life insurance, and health insurance that is made available to all employees. |

Outstanding Equity Awards at 2011 Fiscal Year End

None of our named executive officers had any outstanding equity awards as of the end of fiscal 2011. There were no stock options granted or options exercised during fiscal 2011.

Compensation Program

The Company’s Executive Compensation Program, administered by the Compensation Committee is based on guiding principles designed to align executive compensation with Company values and objectives, business strategy, management initiatives, and financial performance. In applying these principles, the Compensation Committee has an established program intended to:

| • | Reward executives for long-term strategic management and the enhancement of shareholder value. |

| • | Integrate compensation programs with both the Company’s annual and long-term strategic planning. |

| • | Support a performance-oriented environment that rewards performance not only with respect to Company goals, but also Company performance as compared to industry-performance levels. |

Under the Company’s compensation program, the Compensation Committee may recommend the issuance of either cash and/or equity based compensation. The Compensation Committee (the “Committee”) determines the level of salary and bonuses, if any, for executive officers of the Company. The Committee determines the salary or salary range based upon competitive norms. Actual salary changes are based upon performance, and bonuses were awarded by the Committee in consideration of the employee’s performance during the 2011 fiscal year and, except for the Company’s Chief Executive Officer, the recommendation of the Company’s Chief Executive Officer.

8

Employment Agreements

Dunnan D. Edell

On March 21, 2011, the Compensation Committee, acting on behalf of the Company, entered into an Employment Agreement with Dunnan D. Edell, the Company’s President and Chief Executive Officer. Dunnan D. Edell is the son of David Edell, who is a member of the Board of Directors of the Company, and serves as a consultant to the Company, and is also the brother of Drew Edell who is the Company’s Executive Vice President of Research and Development. The Employment Agreement provides for a base salary of $350,000 per annum, which may be increased each year at the discretion of the Compensation Committee. Mr. Edell is also eligible to receive an annual performance-based bonus as awarded by the Compensation Committee, and to participate in the Company’s equity compensation plans. In addition, Mr. Edell receives a company automobile, health insurance and certain other benefits. In the event of termination of the Employment Agreement as a result of the disability or death of the Mr. Edell, he (or his estate or beneficiaries) shall be entitled to receive all base salary and other benefits earned and accrued until such termination as well as a single-sum payment equal to his base salary and a single-sum payment equal to the value of the highest bonus earned by him in the one-year period preceding the date of termination pro-rated for the number of days served in that fiscal year. If the Company terminates Mr. Edell for Cause (as defined in his Employment Agreement), or Mr. Edell terminates his employment in a manner not considered to be for Good Reason, Mr. Edell shall be entitled to receive all base salary and other benefits earned and accrued prior to the date of termination. If the Company terminates Mr. Edell in a manner that is not for Cause or due to his death or disability, Mr. Edell terminates his employment for Good Reason, or the Company does not renew the Employment Agreement after December 31, 2013, then Mr. Edell shall be entitled to receive a single-sum payment equal to his unpaid base salary and other benefits earned and accrued prior to the date of termination and a single-sum payment of an amount equal to three times (a) the average of the base salary amounts paid to Mr. Edell over the three calendar years prior to the date of termination, (b) if less than three years have elapsed between March 21, 2011 and the date of termination, the highest base salary paid to Mr. Edell in any calendar year prior to the date of termination, or (c) if less than twelve months have elapsed between March 21, 2011 and the date of termination, the highest base salary received in any month times twelve. In addition, Mr. Edell is entitled to certain benefits in connection with a Change of Control (as defined in his Employment Agreement). Under the Employment Agreement, Mr. Edell has agreed to non-competition restrictions for a period of six months following the end of the term of his Employment Agreement, during which period Mr. Edell will be paid an amount equal to his base salary for a period of six months, and an amount equal to the pro rata share of any bonus attributable to the portion of the year completed prior to the date of termination. Mr. Edell has also agreed to confidentiality and non-solicitation restrictions under the Employment Agreement.

As a result of the execution of the Employment Agreements referred to above, the Amended and Restated Employment Agreement, by and between Mr. Dunnan D. Edell and the Company, effective as of December 1, 2002 and amended on February 10, 2007 and May 17, 2007, has been terminated.

Stephen A. Heit

On March 21, 2011, the Compensation Committee, acting on behalf of the Company, entered into an Employment Agreement with Stephen A. Heit, the Company’s Executive Vice President and Chief Financial Officer. The Employment Agreement provides for a base salary of $250,000 per annum, which may be increased each year at the discretion of the Compensation Committee upon recommendation of the Chief Executive Officer. Mr. Heit is also eligible to receive an annual performance-based bonus as awarded by the Compensation Committee, and to participate in the Company’s equity compensation plans. In addition, Mr. Heit receives a company automobile, health insurance and certain other benefits. In the event of termination of the Employment Agreement as a result of the disability or death of the Mr. Heit, he (or his estate or beneficiaries) shall be entitled to receive all base salary and other benefits earned and accrued until such termination as well as a single-sum payment equal to the base salary and a single-sum payment equal to the value of the highest bonus earned in the one-year period preceding the date of termination pro-rated for the number of

9

days served in that fiscal year. If the Company terminates Mr. Heit for Cause (as defined in his Employment Agreement), or Mr. Heit terminates his employment in a manner not considered to be for Good Reason, Mr. Heit shall be entitled to receive all base salary and other benefits earned and accrued prior to the date of termination. If the Company terminates Mr. Heit in a manner that is not for Cause or due to his death or disability, Mr. Heit terminates his employment for Good Reason, or the Company does not renew the Employment Agreement after December 31, 2013, then Mr. Heit shall be entitled to receive a single-sum payment equal to his unpaid base salary and other benefits earned and accrued prior to the date of termination and a single-sum payment of an amount equal to three times (a) the average of the base salary amounts paid to Mr. Heit over the three calendar years prior to the date of termination, (b) if less than three years have elapsed between March 21, 2011 and the date of termination, the highest base salary paid to Mr. Heit in any calendar year prior to the date of termination, or (c) if less than twelve months have elapsed between March 21, 2011 and the date of termination, the highest base salary received in any month times twelve. In addition, Mr. Heit is entitled to certain benefits in connection with a Change of Control (as defined in his Employment Agreement). Under the Employment Agreement, Mr. Heit has agreed to non-competition restrictions for a period of six months following the end of the term of his Employment Agreement, during which period Mr. Heit will be paid an amount equal to his base salary for a period of six months, and an amount equal to the pro rata share of any bonus attributable to the portion of the year completed prior to the date of termination. Mr. Heit has also agreed to confidentiality and non-solicitation restrictions under the Employment Agreement.

Drew Edell

On March 21, 2011, the Compensation Committee, acting on behalf of the Company, entered into an Employment Agreement with Drew Edell, the Company’s Executive Vice President of Product Development and Production. Drew Edell is the son of David Edell, who is a member of the Board of Directors of the Company, and serves as a consultant to the Company, and the brother of Dunnan Edell, who is the President and Chief Executive Officer of the Company. The Employment Agreement provides for a base salary of $275,000 per annum, which may be increased each year at the discretion of the Compensation Committee. Mr. Edell is also eligible to receive an annual performance-based bonus as awarded by the Compensation Committee, and to participate in the Company’s equity compensation plans. In addition, Mr. Edell receives a company automobile, health insurance and certain other benefits. In the event of termination of the Employment Agreement as a result of the disability or death of the Mr. Edell, he (or his estate or beneficiaries) shall be entitled to receive all base salary and other benefits earned and accrued until such termination as well as a single-sum payment equal to the base salary and a single-sum payment equal to the value of the highest bonus earned in the one-year period preceding the date of termination pro-rated for the number of days served in that fiscal year. If the Company terminates Mr. Edell for Cause (as defined in his Employment Agreement), or Mr. Edell terminates his employment in a manner not considered to be for Good Reason, Mr. Edell shall be entitled to receive all base salary and other benefits earned and accrued prior to the date of termination. If the Company terminates Mr. Edell in a manner that is not for Cause or due to his death or disability, Mr. Edell terminates his employment for Good Reason, or the Company does not renew the Employment Agreement after December 31, 2013, then Mr. Edell shall be entitled to receive a single-sum payment equal to his unpaid base salary and other benefits earned and accrued prior to the date of termination and a single-sum payment of an amount equal to three times (a) the average of the base salary amounts paid to Mr. Edell over the three calendar years prior to the date of termination, (b) if less than three years have elapsed between March 21, 2011 and the date of termination, the highest base salary paid to Mr. Edell in any calendar year prior to the date of termination, or (c) if less than twelve months have elapsed between March 21, 2011 and the date of termination, the highest base salary received in any month times twelve. In addition, Mr. Edell is entitled to certain benefits in connection with a Change of Control (as defined in his Employment Agreement). Under the Employment Agreement, Mr. Edell has agreed to non-competition restrictions for a period of six months following the end of the term of his Employment Agreement, during which period Mr. Edell will be paid an amount equal to his base salary for a period of six months, and an amount equal to the pro rata share of any bonus attributable to the portion of the year completed prior to the date of termination. Mr. Edell has also agreed to confidentiality and non-solicitation restrictions under the Employment Agreement.

As a result of the execution of the Employment Agreements referred to above, the Amended and Restated Employment Agreement, by and between Mr. Drew Edell and the Company, effective as of December 1, 2002 and amended on February 10, 2007 and May 17, 2007, has been terminated.

10

David Edell and Ira W. Berman

The Company had executed Employment Contracts on December 1, 1993, with its former Chief Executive Officer, David Edell, and its former Corporate Secretary, Ira W. Berman. The contracts for both are the same. Employment under the contracts expired on December 31, 2010, and Mr. Edell and Mr. Berman (the “Consultants”) became consultants for an ensuing five years in accordance with the provisions of the contract. Under the terms of the Employment Contracts, the Company can request that the Consultants each provide consulting services for not more than sixty days per year. For the consulting services provided, the Consultants shall be paid consideration equal to 50% of their annual base salary plus bonus that they received in 2010. The Employment Contracts provide that the consulting payments will increase six (6%) percent for each successive year of the consulting term. The Consultants are also entitled to all benefits that they had previously received as employees for the duration of the consulting term. Mr. Edell remains as a director of the Company, and Mr. Berman was a director until August 4, 2011. During the employment period, the contracts had provided for a base salary which commenced in 1994 in the amount of $300,000 (plus a bonus of 20% of the base salary), with a year-to-year increase equal to the greater of the increase in the CPI or 6%, plus 2.5% of the Company’s pre-tax income plus depreciation and amortization plus certain fringe benefits including the cost of auto expenses, and health insurance. The Consultants were also entitled to reimbursement for a complete physical examination and reimbursement of up to $5,000 of medical expenses for each employment or consulting period. The Company also pays for a life insurance policy owned by each of the Consultants, with a face value of $750,000 for each policy, as per each respective employment agreement. During fiscal 2011, the Company paid premiums totaling $55,993 for both policies. The 2.5% measure in the bonus provision of the Consultant’s contracts was amended on November 3, 1998 so as to calculate it against earnings before income taxes, plus depreciation, amortization and expenditures for media and cooperative advertising in excess of $8,000,000. On May 24, 2001, the contract was amended increasing the base salary then in effect by $100,000 per annum.

On March 15, 2011, the Compensation Committee, acting on behalf of the Company, entered into a Change of Control Agreement (together, the “COC Agreements”) with each of the Consultants. The COC Agreements contained identical terms and conditions to each other and provide that, in the event of a Change of Control of the Company, as defined in the COC Agreements, each of the Consultants is entitled to cease performing consulting services under his respective Employment Contract, and is entitled to certain payments from the Company, including a lump sum payment of all fees under the Employment Contracts from the date of occurrence of the Change of Control through the end of the original term of that Employment Contract. In addition, upon on Change of Control, all of the Consultants’ unvested awards under the Company’s equity-based compensation plans, if any, automatically vest in full. Under the COC Agreements, each Consultant has agreed to a non-competition and non-solicitation restriction for two years, during which two-year period the Consultant is entitled to continued coverage under the Company’s group health, dental, long-term disability and life insurance plans. The foregoing summary of the COC Agreements are qualified in their entirety by the full text of the COC Agreements, copies of which may be found in Form 8-K, filed by the Company with the United States Securities and Exchange Commission on March 17, 2011.

Equity Plans

Long-term incentives may be provided through the issuance of stock options or other equity awards, as determined in the discretion of the Board of Directors.

On June 15, 2005, the shareholders approved an amended and Restated Stock Option Plan amending the 2003 Stock Option Plan (the “Plan”). The Plan authorizes the issuance of up to one million shares of common stock (subject to customary adjustments set forth in the plan) pursuant to equity awards, which may take the form of incentive stock options, nonqualified stock options, restricted shares, stock appreciation rights and/or performance shares. No such grants were issued in fiscal 2011.

11

Awards may be granted under the Plans to employees (including officers and directors who are also employees) of the Company provided, however, that Incentive Stock Options may not be granted to any non-employee director or consultant.

The Plan is administered and interpreted by the Board of Directors. (Where issuance to a Board member is under consideration, that member must abstain.) The Board has the power, subject to plan provisions, to determine the persons to whom and the dates on which awards will be granted, the amount and vesting or exercise provisions of awards, and other terms. The Board has the power to delegate administration to a committee of not less than two (2) Board members, each of whom must be a “non-employee director” within the meaning of Rule 16b-3 under the Securities Exchange Act. Members of the Board receive no compensation for their services in connection with the administration of The Plan.

The Plan permits the exercise of options for cash, or such other method as the Board may permit from time to time.

The maximum term of each option is ten (10) years. No option granted is transferable by the optionee other than upon death.

The exercise price of all options must be at least equal to one hundred percent (100%) of the fair market value of the underlying stock on the date of grant. The aggregate fair market value of stock of the Company (determined at the date of the option grant) for which any employee may be granted Incentive Stock Options in any calendar year may not exceed $100,000, plus certain carryover allowances. The exercise price of an Incentive Stock Option granted to any participant who owns stock possessing more than ten percent (10%) of the voting rights of the Company’s outstanding capital stock must be at least one hundred-ten percent (110%) of the fair market value on the date of grant. As of November 30, 2011, there were no outstanding stock options.

Retirement Benefits

The Company has adopted a 401(K) Profit Sharing Plan that covers all employees with over one year of service and attained age 21, including the executive officers named in the Summary Compensation Table. Employees may make salary reduction contributions up to twenty-five percent of compensation not to exceed the federal government limits. The Plan allows for the Company to make discretionary contributions. For all fiscal periods reflected in the Summary Compensation Table, the Company did not make any contributions.

CORPORATE GOVERNANCE

Board Leadership Structure

The Chairman of the Board of Directors is Stanley Kreitman, who is an independent director, and the President and Chief Executive Officer of the Company is Dunnan D. Edell, who also serves as a director. Drew Edell serves as Corporate Secretary. There is no lead independent director, however, Robert Lage, an independent director, serves as Chairman of the Audit and Compensation Committees. The Company has had separate positions of Chairman of the Board and Chief Executive Officer since its inception.

The Board of Directors consists of seven members, five of whom are independent. Members of the Board of Directors are kept informed of the Company’s operations by reviewing materials provided to them, visiting the Company’s offices, speaking to the executives of the Company and by attending meetings of the Board and its committees. A meeting is held at least once per year with only the independent directors in attendance.

The Board of Director’s leadership is designed so that the independent directors exercise oversight over the Company’s key issues related to strategy and risk. A detailed annual budget is presented and approved by the directors, including plans for media expenditures. Revised forecasts for the fiscal year are presented to the directors as circumstances dictate.

12

Risk Oversight

The Company does not have a risk management committee. Risk oversight is performed by the entire Board of Directors. The Board considers risk levels in various areas of operation of the Company, including, but not limited to, legal and litigation issues, investments in marketable securities, accounts receivable and inventory levels, returns of product, and proposed new products. Robert Lage, the Chairman of the Audit Committee, is in regular communication with Stephen A. Heit, the Company’s Chief Financial Officer, reviewing the Company’s internal controls, compliance with the Sarbanes-Oxley Act, the Company’s financial results and compliance with the Company’s Standard of Business Conduct. All employees, including the executive officers, are required to comply with the Company’s Standard of Business Conduct. A copy of the Standard of Business Conduct is available under Corporate Governance in the Investor Relations section of the Company website www.ccaindustries.com. The Board believes that the close oversight by members of the Board over the Company and its management provides effective risk management of the Company’s operations.

Code of Conduct

The Company has adopted Standard of Business Conduct (our code of ethics), which apply to all directors and employees of the Company, including the Chief Executive Officer and the Chief Financial Officer. A copy of the Standard of Business Conduct may be found in the investor section of the Company’s web site, www.ccaindustries.com, under Corporate Governance. The Company intends to disclose any substantive amendments to the Standard of Business Conduct as well as any waivers from provisions with respect to our Chief Executive Officer, Chief Financial Officer, any principal accounting officer, and any other executive officer or director.

Director Independence

Stanley Kreitman, Sardar Biglari, Philip L. Cooley, James Mastrian and Robert Lage are deemed by the Board of Directors to be “independent” members of the Board of Directors, as determined in accordance with Section 803(a) of the NYSE Amex stock exchange rules and by regulations of the SEC.

There were no related party transactions that occurred between the Company and any of the independent directors, and there were no transactions, relationships or arrangements not disclosed under “Transactions with Related Persons” that were considered by the Board under the applicable independence definitions in determining that the director is independent.

Board Meetings

During fiscal year 2011, the Board of Directors held nine meetings, the Audit Committee held four meetings, the Compensation Committee held one meeting, the Nominating Committee held one meeting, and the Investment Committee held four meetings. All of the directors attended 100% of all of the meetings of the Board and at least 75% of the respective committees of the Board of which they were members.

All of the Company’s directors were present at the last annual meeting. The Company does not have a policy with regards to directors’ attendance at annual shareholder meetings.

13

Committees of the Board

The following chart shows the standing committees of the Board of Directors and their members:

| AUDIT | COMPENSATION | INVESTMENT | NOMINATING | |||||

| Sardar Biglari |

ü | |||||||

| Philip L. Cooley |

ü | ü | ||||||

| David Edell |

ü | |||||||

| Dunnan D. Edell |

||||||||

| Stanley Kreitman |

ü | ü | ü | ü | ||||

| Robert Lage |

ü | ü | ü | ü | ||||

| James Mastrian |

ü | ü |

Audit Committee

The Company has an Audit Committee comprised solely of independent directors. Mr. Lage serves as Chairman of the Audit Committee. Robert Lage, a retired certified public accountant, and Stanley Kreitman, former president of a national bank, are deemed by the Board of Directors to be “audit committee financial experts” as defined by the SEC rules and are “financially sophisticated” as defined by NYSE-Amex rules.

The Audit Committee is appointed by the Board to assist the Board with oversight of (i) the integrity of the financial statements of the Company, (ii) the Company’s compliance with legal and regulatory requirements, (iii) the independence and qualifications of the Company’s external auditors, and (iv) the performance of the Company’s internal audit function and external auditors. It is the Audit Committee’s responsibility to retain or terminate the Company’s independent registered public accountants, who audit the Company’s financial statements, and to prepare the Audit Committee report that the SEC requires to be included in the Company’s Annual Proxy Statement. As part of its activities, the Audit Committee meets with the Company’s independent registered public accountants at least annually to review the scope and results of the annual audit and quarterly to discuss the review of the quarterly financial results. In addition, the Audit Committee receives and considers the independent registered public accountants’ comments and recommendations as to internal controls, accounting staff, management performance and auditing procedures. The Audit Committee is also responsible for establishing procedures for (i) the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls and auditing matters and (ii) the confidential, anonymous submission by employees of the Company of concerns regarding questionable accounting or auditing matters.

Regarding fiscal 2011, the Audit Committee (a) reviewed and discussed the Company’s audited financial statements with management; (b) received and discussed the information required to be discussed, pursuant to auditing standards and SEC regulations with the Company’s independent auditors; (c) received written disclosures, and the letter concerning same, from the independent auditors as required by the Public Company Accounting Oversight Board; (d) discussed the independence of the auditors, with the auditors; and (e) recommended that the audited financial statements be included in the Company’s Annual Report on Form 10-K.

An Audit Committee Charter was adopted by the full Board of Directors. A copy of the Audit Committee Charter can be found in the investor relations section of the Company’s website at www.ccaindustries.com.

14

Compensation Committee

Mr. Lage serves as Chairman of the Compensation Committee.

The functions of the Compensation Committee include evaluating the performance of the Chief Executive Officer, and other executive officers of the Company, and, based on this evaluation, determining the compensation of the Chief Executive Officer and the Company’s other executive officers; making recommendations to the Board of Directors with respect to compensation of non-management directors; determining and administering, the Company’s compensation plans; and performing other related functions specified in the Committee’s charter.

A Compensation Committee Charter was adopted by the full Board of Directors. The charter was amended by the Board of Directors on May 23, 2011. A copy of the amended Committee Charter can be found in the investor relations section of the Company’s web site at www.ccaindustries.com.

Nominating Committee

Stanley Kreitman serves as Chairman of the Nominating Committee. There is no charter for the Nominating Committee.

The Nominating Committee’s responsibilities include, among other things, identifying individuals qualified to become Board members and recommending to the Board nominees to stand for election at any meeting of shareholders, and identifying and recommending nominees to fill any vacancy, however created, in the Board.

Nominees for director are selected on the basis of broad experience and diversity, which includes differences of viewpoint, professional experience, education, skill and other individual qualities. In addition, integrity, the ability to make independent analytical inquiries, an understanding of the Company’s business environment with particular emphasis on consumer products and the Company’s retail partners, and a willingness to devote adequate time to Board of Director duties are also considered. The Committee may consider candidates proposed by management or shareholders but is not required to do so. Except as described in the next paragraph, the Committee does not have any formal policy with regard to the consideration of any director candidates recommended by the security holders or any minimum qualifications or specific procedure for identifying and evaluating nominees for director as the Board does not believe that such a formalistic approach is necessary or appropriate at this time.

Shareholders who wish to recommend candidates for consideration by the Nominating Committee for Board membership may do so by writing to CCA Industries Inc., Attention: Nominating Committee, 200 Murray Hill Parkway, East Rutherford, NJ 07073. To be considered for the 2013 Annual Meeting, such recommendations must be received by the Company no earlier than March 12, 2013 and no later than April 11, 2013. Any such proposal shall contain the name, Company security holdings and contact information of the person making the nomination; the candidate’s name, address and other contact information; any direct or indirect holdings of the Company’s securities by the nominee; any information required to be disclosed about directors under applicable securities laws and/or stock exchange requirements; information regarding related party transactions with the Company and/or the shareholder submitting the nomination; any actual or potential conflicts of interest; the nominee’s biographical data, current public and private company affiliations, employment history and qualifications and status as “independent” under applicable securities laws and stock exchange requirements as well as any other information required to be provided for shareholder nominations under to Section 2.5 of the Company’s Amended and Restated Bylaws. Director candidates recommended by shareholders will receive the same consideration as other nominees.

Investment Committee

Robert Lage serves as Chairman of the Investment Committee. The Investment Committee’s responsibilities are to set investment policies (subject to approval of the Board of Directors) and guidelines, including policies and guidelines regarding asset classes, asset allocation ranges, and prohibited investments, and to review the management and performance of the Company’s investments.

15

Communications with Directors

Shareholders of the Company who wish to communicate with the Board or any individual director can write to CCA Industries, Inc., Investor Relations, 200 Murray Hill Parkway, East Rutherford, NJ 07073 or send an email to boardofdirectors@ccaindustries.com. Your letter or email should indicate that you are a shareholder of the Company. Depending on the subject matter of your inquiry, management will forward the communication to the director or directors to whom it is addressed; attempt to handle the inquiry directly, as might be the case if you request information about the Company or it is a shareholder related matter; or not forward the communication if it is primarily commercial in nature or if it relates to an improper topic. At each Board meeting, a member of management presents a summary of all communications received since the last meeting that were not forwarded and makes those communications available to any requesting director.

16

TRANSACTIONS WITH RELATED PERSONS

The Company’s policy regarding transactions with related persons requires transactions with related persons to be reviewed and approved or ratified by the Company’s Audit Committee as well as by the Company’s Chief Executive Officer and Chief Financial Officer. In this regard, all such transactions are first discussed with the Chief Executive Officer and the Chief Financial Officer for an initial determination of whether such further related person transaction review is required. The Company utilizes the definition of related persons under applicable SEC rules, defined as any executive officer, director or nominee for director of the Company, any beneficial owner of more than 5% of the outstanding shares of the Company’s common stock, or any immediate family member of any such person. In reviewing these transactions, the Company strives to assure that the terms of any agreement between the Company and a related party is at arm’s length, fair and at least as beneficial to the Company as could be obtained from third parties. The Audit Committee, in its discretion, may consult with third party appraisers, valuation advisors or brokers to make such determination.

During fiscal 2011, as per their respective Employment Agreements, the Company made payments of $648,628 each to David Edell and Ira Berman for consulting services provided during fiscal 2011 and, in fiscal 2010 and 2011, also paid life insurance policy premiums totaling $55,993 and $55,993, respectively for policies owned by David Edell and Ira Berman. In addition, in March 2011, the Company entered into Change of Control Agreements with each of David Edell and Ira Berman, which could result in payments to such persons in the event of a Change of Control of the Company (as defined in the Change of Control Agreements). Both of David Edell and Ira Berman served as executives of the Company in fiscal 2010 and are each currently beneficial owners of greater than 5% of the Company’s voting securities. David Edell currently serves as a director of the Company and Mr. Berman served as a director of the Company during fiscal 2011. See “Employment Agreements – David Edell and Ira W. Berman” above for additional information on the Employment Agreements and Change of Control Agreements.

The Company has not entered into any other transactions, other than as disclosed above, since the beginning of the Company’s last two fiscal years, or has proposed to enter into any transaction, other than as disclosed above, in which any related person had or will have a direct or indirect material interest.

17

PROPOSAL NO. 1

ELECTION OF DIRECTORS

The seven directors named herein are nominated to be elected to the Company’s Board of Directors. All directors are subject to one-year terms and annual election. Four directors are elected by the holders of Class A Common Stock and three directors are elected by the holders of Common Stock. Each director holds office until the next Annual Meeting of Shareholders and until a successor is elected and qualified, or until death, resignation or removal. Each of the director nominees has agreed to be named in this proxy statement and to serve if elected. Management has no reason to believe that any of the nominees will be unable or unwilling for good cause to serve if elected. However, if any nominee should become unable for any reason or unwilling for good cause to serve, proxies may be voted, to the extent permitted by applicable law, for another person nominated as a substitute by the Board.

The four nominees for election by the holders of the Company’s Class A Common Stock (David Edell, Robert A. Lage, James P. Mastrian and Stanley Kreitman) served as directors since the 2011 Annual Meeting of Shareholders. The three nominees for election by the holders of Common Stock (Dunnan D. Edell, Sardar Biglari and Philip L. Cooley) were recommended for election by the Nominating Committee of the current Board of Directors. Sardar Biglari, Philip L. Cooley and Dunnan D. Edell have served as directors since the 2011 Annual Meeting of Shareholders.

There were no arrangements or understandings between any director or nominee for director and any other person pursuant to which such person was selected as a director or nominee for director. There are no family relationships among any of the directors or executive officers or nominees for director or executive officer, except that David Edell, a director, is the father of Dunnan D. Edell, the President and Chief Executive Officer and a director, and Drew Edell, Executive Vice President of Product Development and Production, and Corporate Secretary.

The following table summarizes information with respect to the nominees:

| Name |

Age | Director Since | ||||||

| Class A Common Stock Nominees: |

||||||||

| David Edell |

80 | 1983 | ||||||

| Stanley Kreitman |

79 | 1996 | ||||||

| Robert A. Lage |

75 | 2003 | ||||||

| James P. Mastrian |

69 | 2009 | ||||||

| Common Stock Nominees: |

||||||||

| Dunnan D. Edell |

56 | 1994 | ||||||

| Sardar Biglari |

34 | 2011 | ||||||

| Philip L. Cooley |

68 | 2011 | ||||||

Set forth below is additional information regarding all nominees for director, including information concerning their principal occupations and certain other directorships.

Class A Common Stock Nominees

No vote or proxy is solicited in respect of the nominees to be elected by the holders of Class A Common Stock, since Messrs. Ira W. Berman and David Edell, own all of the shares of Class A Common Stock, and they have jointly proposed David Edell, Mr. Kreitman, Mr. Lage and Mr. Mastrian for re-election.

David Edell served as the Company’s Chief Executive Officer from 1983 to December 2010, and currently serves as a director of the Company and also as a consultant to the Company. Prior to his association with the Company, he was a marketing and financial consultant; and, by 1983, he had extensive experience in the health and beauty aids field as an executive director and/or officer of Hazel Bishop, Lanolin Plus and Vitamin Corporation of America. In 1954, David Edell received a Bachelor of Arts degree from Syracuse University. Mr. Edell is the father of Dunnan Edell and Drew Edell.

18

Director Qualifications

| • | Extensive experience in the consumer products market segment |

| • | Founder of the Company and leadership role since inception |

Stanley Kreitman has been Chairman of the Board of CCA Industries, Inc. since 2011, and Vice Chairman of Manhattan Associates, an equity investment firm, since 1994. He is a director of Medallion Financial Corp., a NASDAQ listed company, Capital Lease Financial Corp, a NYSE listed company and KSW Corp. He also serves as a director of the New York City Board of Corrections, Nassau County Crime Stoppers, and serves on the board of the Police Athletic League. From 1975 to 1993 he was President of United States Banknote Corp. (NYSE), a securities printer.

Director Qualifications

| • | Leadership experience as President of United States Banknote Corporation |

| • | Extensive experience serving on boards of directors of various corporations and organizations |

| • | Deemed by the Board of Directors to be an “audit committee financial expert” as defined by the SEC rules and “financially sophisticated” as defined by the NYSE-Amex rules. |

Robert A. Lage, is a director of the Company, and a retired CPA. He was a partner at Price Waterhouse Coopers Management Consulting Service prior to his retirement in 1997. He has been engaged in the practice of public accounting and management consulting since 1959. He received a BBA from Bernard Baruch College of The City University of New York in 1958.

Director Qualifications

| • | Certified Public Accountant since 1959 |

| • | Extensive experience as a partner at Price Waterhouse Coopers Management Consulting Service |

| • | Deemed by the Board of Directors to be an “audit committee financial expert” as defined by the SEC rules and “financially sophisticated” as defined by NYSE-Amex rules |

James P. Mastrian is a director of the Company. He retired from Rite Aid Corp. in August 2008. He was the special advisor to the Chairman and Chief Executive Officer. Prior to that, he was the Chief Operating Officer of Rite Aid Corp. from October 2005 to August 2007. He had been Senior Executive Vice President, Marketing, Logistics and Pharmacy Services from November 2002 to October 2005, and was Senior Executive Vice President, Marketing and Logistics of Rite Aid from October 2000 until November 2002. Prior to that he was Executive Vice President, Marketing from November 1999 to October 2000. Mr. Mastrian was also Executive Vice President, Category Management of Rite Aid from July 1998 to November 1999. Mr. Mastrian was Senior Executive Vice President, Merchandising and Marketing of OfficeMax, Inc. from June 1997 to July 1998 and Executive Vice President, Marketing of Revco D.S., Inc. from July 1994 to June 1997, and served in other positions from September 1990. Mr. Mastrian received a B.S. Pharmacy from the University of Pittsburgh in 1965.

Director Qualifications

| • | Leadership role in the retail sector with a large chain drug store company |

| • | Extensive marketing experience at retail |

Common Stock Nominees

The Nominating Committee is proposing Dunnan D. Edell, Sardar Biglari and Philip L. Cooley for election by the holders of Common Stock at the Annual Meeting.

Dunnan D. Edell is a director of the Company and has served as the Company’s President and Chief Executive Officer since the beginning of the 2011 fiscal year. Prior to that, Mr. Edell served as President and Chief Operating Officer since fiscal 2003. Mr. Edell joined the Company in 1984, and was appointed Divisional Vice-President in 1986. He has been a director since 1994. He is a graduate of the George Washington University. He was employed by Alleghany Pharmacal Corporation from 1982 to 1984 and by Hazel Bishop from 1977 to 1981. Mr. Edell is the son of David Edell and the brother of Drew Edell.

19

Director Qualifications

| • | President of the Company since 2003, served with the company since 1984. |

| • | Experienced in the consumer products market place. |

Sardar Biglari is a director of the Company. He has served as Chairman, since June 2008, and Chief Executive Officer, since August 2008, of Biglari Holdings Inc., a diversified holding company, and Chairman and Chief Executive Officer of Biglari Capital Corp., a wholly-owned subsidiary of Biglari Holdings Inc. and general partner of The Lion Fund, L.P., a private investment fund, since its inception in 2000. He has also served as Chairman, since March 2006, Chief Executive Officer and President, since May 2007, and a director, since December 2005, of Western Sizzlin Corporation, a diversified holding company, which was acquired by Biglari Holdings Inc. in March 2010.

Director Qualifications

| • | Mr. Biglari has extensive managerial and investing experience in a broad range of businesses through his services as Chairman and Chief Executive Officer of Biglari Holdings Inc. and its major operating subsidiaries. |

| • | Experience serving on the boards of directors of public companies. |

Philip L. Cooley is a director of the Company. He has served as Vice Chairman of the Board of Biglari Holdings Inc. since April 2009, and as a director since 2008, as well as Chairman of the audit committee. He was the Prassel Distinguished Professor of Business at Trinity University, San Antonio, Texas, from 1985 to May 2012. Dr. Cooley served as an advisory director of Biglari Capital Corp., general partner of The Lion Fund, L.P., since 2000 and as Vice Chairman and a director of Western Sizzlin Corporation from March 2006 and December 2005, respectively, until its acquisition by Biglari Holdings Inc. in March 2010. Dr. Cooley earned a Ph.D. from Ohio State University, a MBA from the University of Hawaii and a BME from the General Motors Institute. Dr. Cooley is past president of the Eastern Finance Association, and serves on its board, and of the Southern Finance Association. He also serves on the board of the Consumer Credit Counseling Service of Greater San Antonio.

Director Qualifications

| • | Dr. Cooley has extensive business and investment knowledge and experience. |

| • | Experience serving on the boards of directors of public companies. |

| • | Author of more than 60 articles on financial topics, his work has appeared in the Journal of Finance, Journal of Business and others. He also has authored several books in finance. |

Required Vote

Directors are elected by the plurality of votes cast in person or by proxy, provided a quorum is present at the Annual Meeting. Accordingly, abstentions and broker non-votes will not affect the outcome of the election.

RECOMMENDATION OF THE BOARD OF DIRECTORS

The Board of Directors unanimously recommends a vote in favor of each of the Common Stock nominees as proposed in this Proposal No. 1.

20

DIRECTOR COMPENSATION

Each outside director was paid $2,500 per meeting for attendance at Board meetings by teleconference and $5,000 per meeting for attendance at Board meetings in person in fiscal 2011 (without additional compensation for committee meetings, other than as noted below). Effective August 4, 2011, the Board of Directors approved an annual retainer of $25,000 for each outside director, in addition to the conference call or in person meeting payments. The Board of Directors met five times in person during fiscal 2011, and an additional four times by teleconference call, for an aggregate compensation of $352,500, not including Mr. Lage’s additional compensation of $30,000 as chairman of the Audit Committee. No stock options were awarded. The following table summarizes the fees earned or paid in cash to each director, with respect to their service as directors, during fiscal 2011:

| Fees Earned or Paid |

||||||||

| Name |

or Paid in Cash | Total | ||||||

| Ira Berman (1) |

$ | 25,000 | $ | 25,000 | ||||

| Sardar Biglari (1) |

35,000 | 35,000 | ||||||

| Philip L. Cooley (1) |

35,000 | 35,000 | ||||||

| David Edell |

60,000 | 60,000 | ||||||

| Stanley Kreitman |

60,000 | 60,000 | ||||||

| Robert Lage |

90,000 | 90,000 | ||||||

| James Mastrian |

57,500 | 57,500 | ||||||

| Jack Polak (1) |

20,000 | 20,000 | ||||||

| (1) | Ira Berman and Jack Polak were directors until August 4, 2011. Sardar Biglari and Philip L. Cooley were elected directors on August 4, 2011. |

Board members who are also officers are not separately compensated for their services as directors.

21

PROPOSAL NO. 2

RATIFICATION OF APPOINTMENT OF AUDITORS

The Audit Committee has appointed the firm of BDO USA, LLP, as the Company’s principal independent registered public accounting firm (the “Auditors”), to audit the accounts and certify the financial statements of the Company for the fiscal year ending November 30, 2012. The appointment shall continue at the pleasure of the Audit Committee, subject to ratification by the shareholders. The Auditors have acted as the Company’s auditors commencing with the review of the first quarter of fiscal 2012.

On March 7, 2012, the Company engaged BDO USA, LLP as the Company’s principal independent registered public accounting firm to audit its financial statements, replacing KGS LLP as the Company’s independent registered public accounting firm, who were dismissed on the same day. The change was approved by the Audit Committee of Registrant’s Board of Directors.

The Company had not consulted with BDO USA, LLP during the two fiscal years ended November 30, 2011 and November 30, 2010 and the subsequent interim period through March 7, 2012, regarding (i) the application of accounting principles to a specified transaction either completed or proposed or the type of audit opinion that might be rendered on the Company’s consolidated financial statements, and neither a written report was provided to the Company nor oral advice was provided that BDO USA, LLP concluded was an important factor considered by the Company in reaching a decision as to the accounting, auditing or financial reporting issue; or (ii) any matter that was either the subject of a “disagreement,” as that term is defined in Item 304(a)(1)(iv) of Regulation S-K and the related instructions to Item 304 of Regulation S-K, or a “reportable event,” as that term is defined in Item 304(a)(1)(v) of Regulation S-K.

KGS LLP’s report on the Company’s financial statements as of and for the fiscal years ended November 30, 2010 and 2011 did not contain any adverse opinion or disclaimer of opinion and was not qualified or modified as to uncertainty, audit scope or accounting principles.

During the Company’s fiscal years ended November 30, 2010, and November 30, 2011 and the subsequent interim period through March 7, 2012, there were (i) no disagreements between the Registrant and KGS LLP on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure, which, if not resolved to the satisfaction of KGS LLP would have caused KGS LLP to make reference thereto in their reports on the financial statements for such years, and (ii) no “reportable events” as that term is defined in Item 304(a)(1)(v) of Regulation S-K.

The Registrant provided KGS LLP with a copy of the Form 8-K disclosing the above matters, which was filed on March 7, 2012. KGS LLP furnished the Company with a letter addressed to the SEC stating that KGS LLP agreed with the statements made in the Form 8-K regarding KGS LLP. A copy of such letter, dated March 7, 2012, was filed as Exhibit 16.01 to the Form 8-K.

The Board of Directors expects that one or more representatives of the Auditors will be present at the meeting. The Auditors will then be given the opportunity to make a statement, and will be available to respond to appropriate questions.

The ratification of the Board’s selection of BDO USA, LLP will require the affirmative vote of a majority of the outstanding Common Stock present in person or by proxy and entitled to vote, provided a quorum is present at the Annual Meeting. Abstentions will be counted for the purpose of meeting the quorum requirements and will have the same effect as a vote against the ratification of the Board’s selection of BDO USA, LLP. Broker non-votes will have no effect on the outcome of the proposal.

RECOMMENDATION OF THE BOARD OF DIRECTORS

The Board of Directors unanimously recommends a vote in favor of Proposal No. 2.

22

SERVICES PROVIDED BY THE AUDITOR AND FEES PAID

Audit Committee Pre-Approval of Services

The Audit Committee pre-approved all audit and non-audit services provided to the Company in fiscal 2011 and 2010 by KGS LLP. Under its charter, the Audit Committee must pre-approve all subsequent engagements of our independent registered public accounting firm unless an exception to such pre-approval exists under the Securities Exchange Act of 1934 or the rules of the SEC. Each year, before a independent registered public accounting firm is retained to audit our financial statements, such service and the associated fee, is approved by the Committee. At the beginning of the fiscal year, the Audit Committee evaluates other known potential engagements of the independent registered public accounting firm, including the scope of the work proposed to be performed and the proposed fees, and approves or rejects each service, taking into account whether the services are permissible under applicable law and the possible impact of each non-audit service on the independent registered public accounting firm’s independence from management. At each subsequent Committee meeting, the Committee receives updates on the services actually provided by the independent registered public accounting firm, and management may present additional services for approval. The Committee has delegated to the Chairman of the Committee the authority to evaluate and approve engagements on behalf of the Committee in the event that a need arises for pre-approval between committee meetings. If the Chairman so approves any such engagements, he will report that approval to the full Audit Committee at its next meeting.

Audit Fees

KGS LLP served as the Company’s independent auditors for fiscal year 2011 and 2010. The services performed by KGS LLP in this capacity included conducting an audit in accordance with generally accepted auditing standards and expressing an opinion on the Company’s consolidated financial statements.

KGS LLP fees for professional services rendered in connection with the audit and review of Form 10-K and all other SEC regulatory filings were $255,000 for the 2011 fiscal year and $320,000 for the 2010 fiscal year. The Company has paid and is current on all billed fees.

Audit-Related Fees

Audit-related fees billed in fiscal 2011 and 2010 by KGS LLP were $7,500 and $2,500, respectively. Audit related fees consist primarily of fees billed for professional services rendered by KGS for accounting consultations and audit work related to certain contract negotiations.

Tax Fees

KGS LLP fees for professional services rendered in connection with Federal and State tax return preparation and other tax matters for the 2011 and 2010 fiscal years were $30,000 and $35,000, respectively.

All Other Fees

There were no all other fees billed by KGS LLP in fiscal years 2011 and 2010, other than those described above.

23

REPORT OF THE AUDIT COMMITTEE*

The Audit Committee of the Board operates under its charter, which was originally adopted by the Board in 2000. Management is responsible for the Company’s internal accounting and financial controls, the financial reporting process, the internal audit function and compliance with the Company’s policies and legal requirements. The Company’s independent registered public accountants are responsible for performing an independent audit of the Company’s consolidated financial statements in accordance with standards of the Public Company Accounting Oversight Board (United States) and for issuance of a report thereon; they also perform limited reviews of the Company’s unaudited quarterly financial statements.