UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant |X| Filed by a Party other than the Registrant |_|

Check the appropriate box:

|_| Preliminary Proxy Statement

|_| Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|x| Definitive Proxy Statement

|_| Definitive Additional Materials

|_| Soliciting Material under Rule 14a-12

CCA Industries, Inc.

(Name of Registrant as Specified in Its Charter)

------------------------------------------------------------

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|x| No fee required

|_| Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11

(1) Title of each class of securities to which transaction applies:

_____________________________________________________________

(2) Aggregate number of securities to which transaction applies:

_____________________________________________________________

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

_____________________________________________________________

(4) Proposed maximum aggregate value of transaction:

_____________________________________________________________

(5) Total fee paid:

_____________________________________________________________

|_| Fee paid previously with preliminary materials.

|_| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

_____________________________________________________________

(2) Form, Schedule or Registration Statement No.:

_____________________________________________________________

(3) Filing Party:

_____________________________________________________________

_____________________________________________________________

June 7, 2013

Dear Shareholders:

Your company is recovering from the tragic loss of its former CEO and my son Dunnan Edell due to a sudden unexpected heart attack. Through the time CCA started its business, and until his demise, Dunnan successfully presented CCA to our retail customers as an important and quality supplier for their businesses. He will be significantly missed.

In order to expedite the continuity of CCA's business, I accepted the Board of Directors request to come out of every day retirement and resume the position of CEO until a more permanent CEO can be recruited. To assist me I asked the board to elect Steve Heit, who successfully had been operating as the company's CFO, to become president and oversee the daily operations reporting directly to myself.

The 2012 fiscal year was very challenging for our company. Although net sales increased by 8.6% compared to the prior year our net profits were minimal. The loss of retail promotions for our diet aid supplements and the significant damages our executive offices and warehouse suffered from “Super Storm Sandy” were the primary causes of a disappointing fiscal year. We have started in fiscal 2013 to revise our entire sales and marketing strategies that will include the introduction of new products to begin shipping in the 4th quarter. In addition, we are focused on expanding the distribution and increasing the vitality and visibility of our core brands at all retail levels. I am very confident that the company will soon return to demonstrating that it can readily grow its revenues on a solid profitable basis that will provide greater shareholder value.

At this time the company has sufficient cash and no debt to enable it to go forward with its marketing plans. It is still the philosophy of our Board of Directors, if pragmatic, to continue quarterly distribution of dividends to its shareholders.

Sincerely,

/s/ David Edell

David Edell

Chief Executive Officer

/s/ Stanley Kreitman

Stanley Kreitman

Chairman of the Board

/s/ Stephen A. Heit

Stephen A. Heit

President and Chief Financial Officer

CCA INDUSTRIES, INC.

TO BE HELD ON JULY 18, 2013

TO THE SHAREHOLDERS:

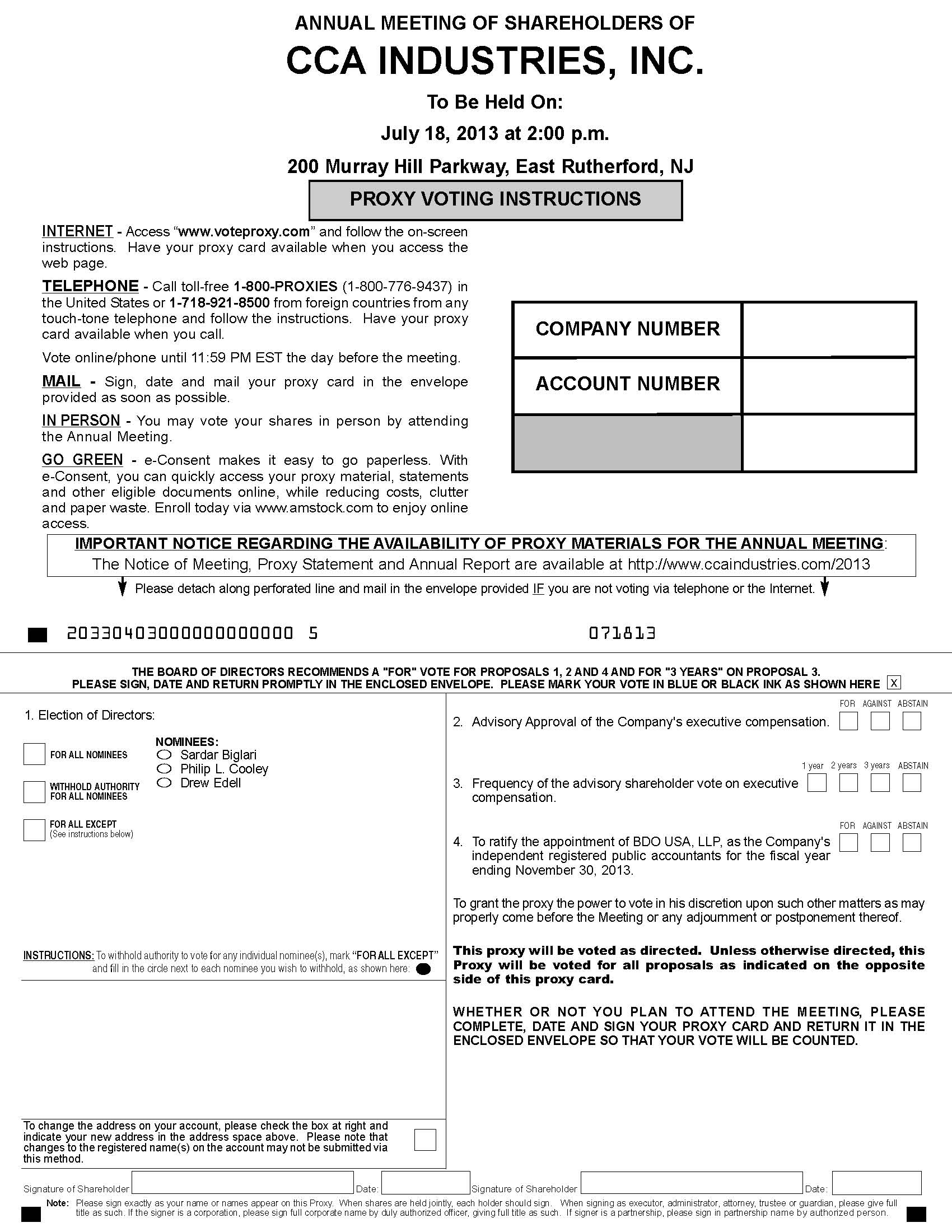

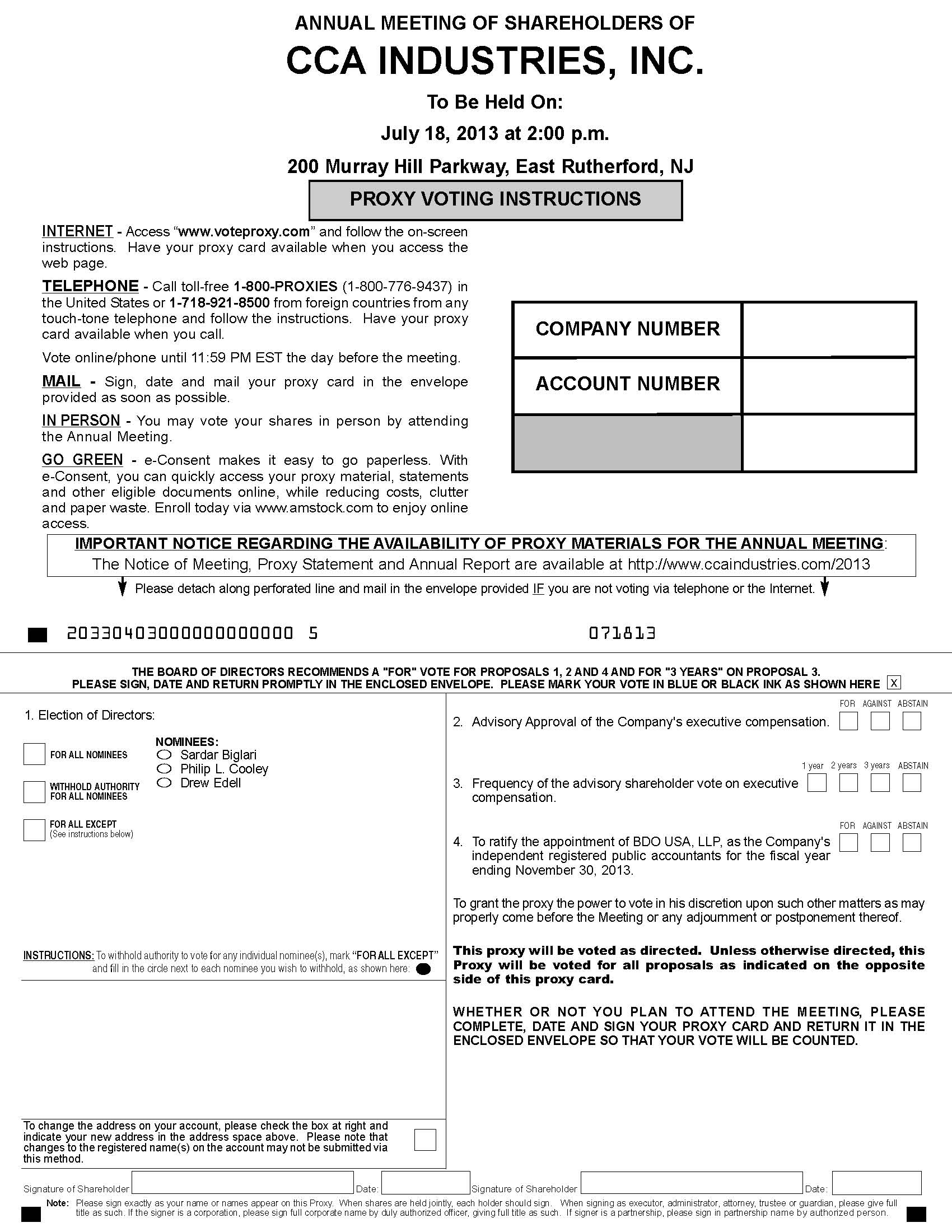

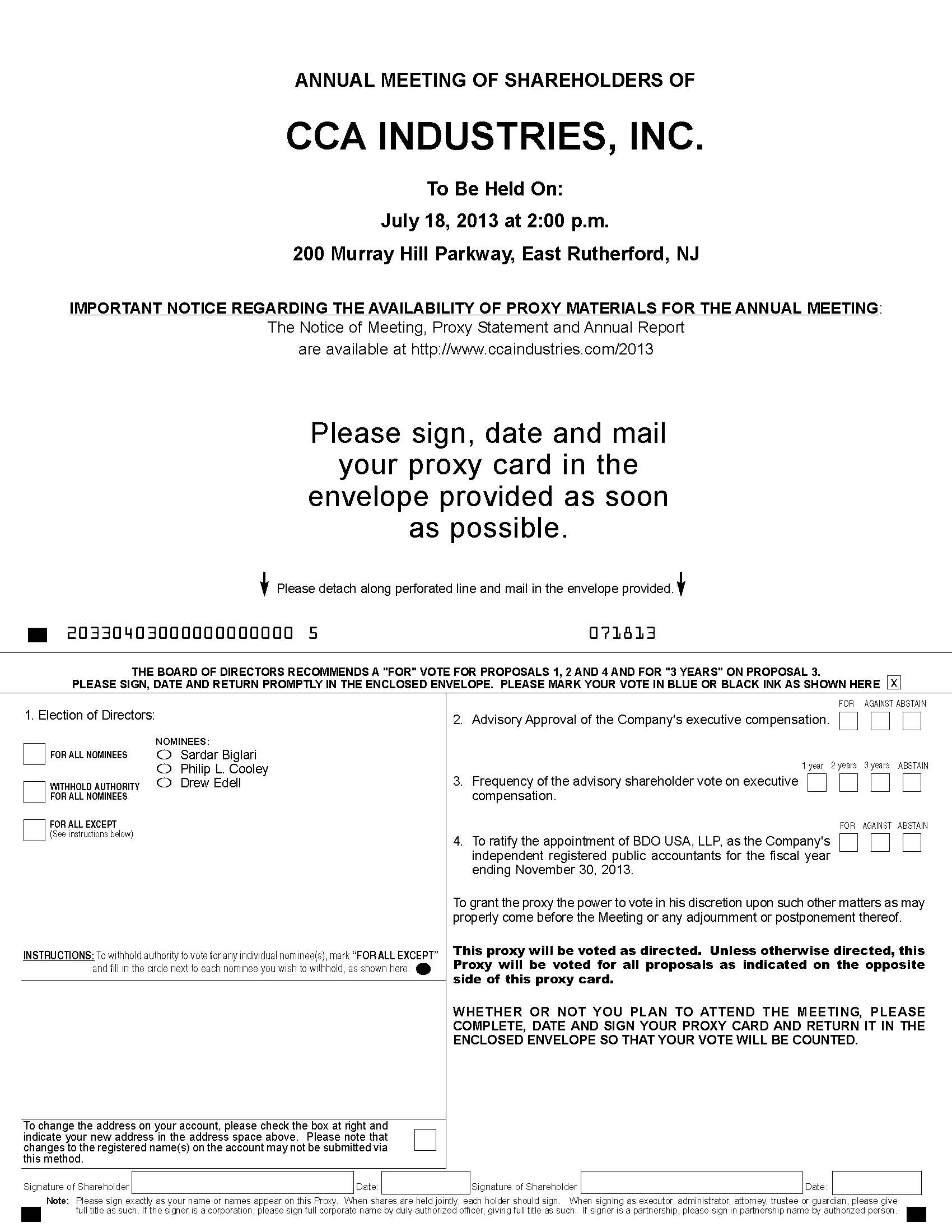

NOTICE IS HEREBY GIVEN that the Annual Meeting of the Shareholders of CCA INDUSTRIES, INC., a Delaware corporation (hereinafter, the “Company”) will be held on July 18, 2013, at 2:00 p.m., at the offices of the Company, 200 Murray Hill Parkway, East Rutherford, New Jersey 07073, for the following purposes:

Management Proposals

| |

1. | To elect as directors the seven nominees named in the attached Proxy Statement (four of whom are to be elected by the Class A Common Stock Shareholders and three of whom are to be elected by Common Stock Shareholders). |

| |

2. | To approve on an advisory basis, the Company's executive compensation. |

| |

3. | To hold an advisory vote on the frequency of the Company’s advisory on executive compensation. |

| |

4. | To ratify the appointment of BDO USA, LLP as the Company’s independent registered public accountants for the fiscal year ending November 30, 2013. |

Such other business, if any, as may properly come before the meeting or any adjournment thereof, shall also be considered.

The identified proposals are more fully described, and related information is presented, in the Proxy Statement accompanying this Notice.

Only shareholders of record at the close of business on June 5, 2013 are entitled to notice of the meeting, and to vote at the meeting and at any continuation or adjournment thereof.

Your vote is very important. All shareholders are requested to be present at the meeting in person or by proxy so that a quorum may be ensured. Alternatively, you may vote via the telephone, internet, or by completing and returning the enclosed proxy card.

BY ORDER OF THE BOARD OF DIRECTORS

Stanley Kreitman

Chairman of the Board

East Rutherford NJ

June 7, 2013

WHETHER OR NOT YOU PLAN TO ATTEND THIS MEETING, YOU ARE URGED TO EITHER VOTE BY TELEPHONE OR INTERNET, OR BY COMPLETING, SIGNING AND RETURNING THE ENCLOSED PROXY. NO POSTAGE NEED BE AFFIXED IF MAILED IN THE UNITED STATES AND IN THE ENVELOPE PROVIDED WITH THE PROXY CARD.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON JULY 18, 2013.

Our Notice of Annual Meeting, Proxy Statement, Letter to Shareholders and Annual Report are available online at:

www.ccaindustries.com/2013

CCA INDUSTRIES, INC.

200 Murray Hill Parkway

East Rutherford, New Jersey 07073

www.ccaindustries.com

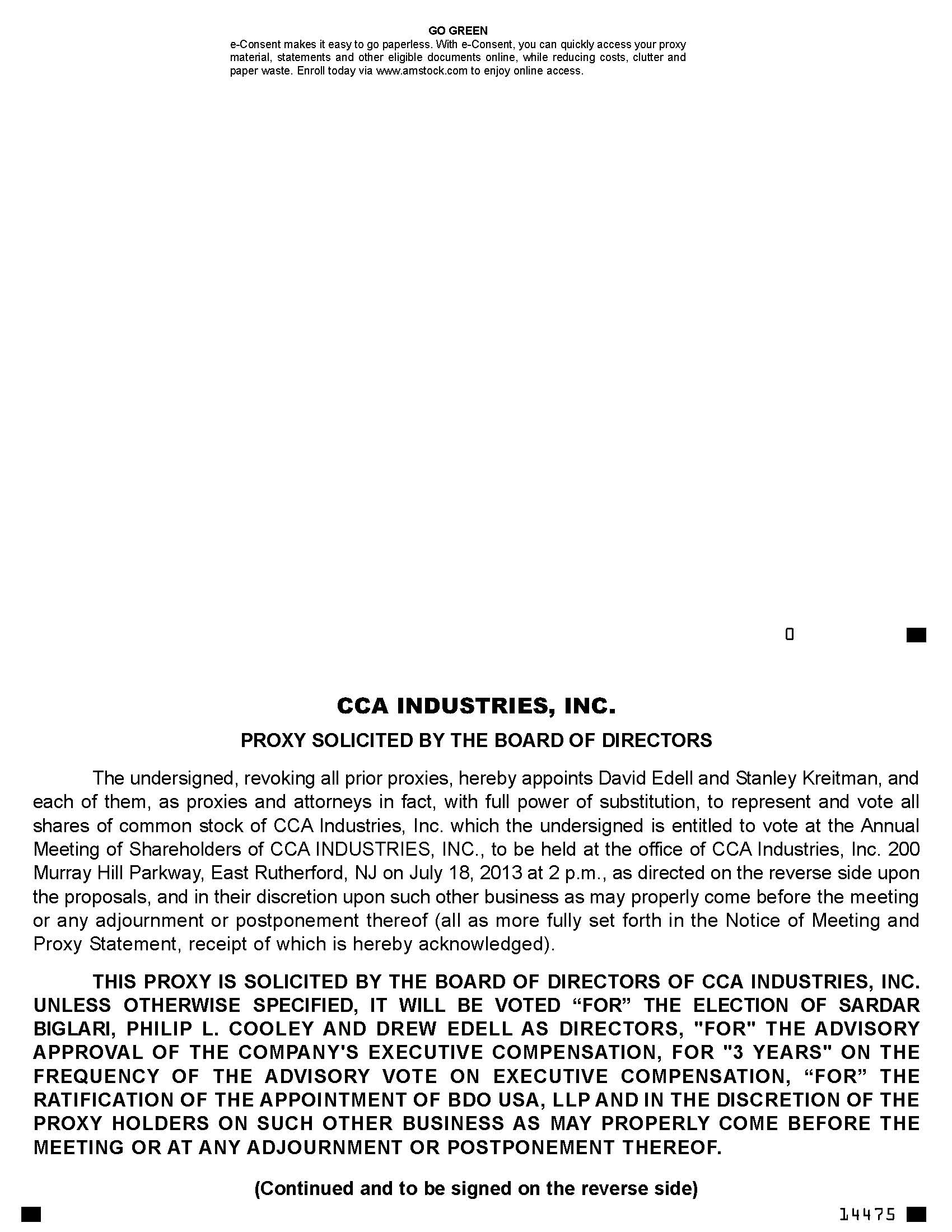

The enclosed proxy is solicited on behalf of the Board of Directors of CCA INDUSTRIES, INC., a Delaware corporation (hereinafter, the “Company”), for use at its Annual Meeting of Shareholders to be held on July 18, 2013, at 2:00 p.m., at the Company’s offices, 200 Murray Hill Parkway, East Rutherford, New Jersey 07073 (hereinafter the “Annual Meeting”). Shareholders of record on June 5, 2013 will be entitled to vote. The Company has made the proxy materials available to the shareholders of record at www.ccaindustries.com/2013 beginning on June 7, 2013 and the proxy materials are being mailed to the shareholders on or about June 7, 2013.

Abstentions and Broker Non-Votes. Abstentions and broker non-votes are counted for purposes of determining the presence or absence of a quorum for the transaction of business. Abstentions occur when shareholders are present at the Annual Meeting but choose to withhold their vote for any of the matters upon which the shareholders are voting. “Broker non-votes” occur when other holders of record (such as banks and brokers) that hold shares on behalf of beneficial owners do not receive voting instructions from the beneficial owners before the Annual Meeting, and do not have discretionary authority to vote those shares if they do not receive timely instructions from the beneficial owners. At the Annual Meeting, brokers will not have discretionary authority to vote on Proposal No. 1, Election Of Directors, Proposal No. 2, Advisory Vote on Executive Compensation, Proposal No. 3, Advisory Vote on the Frequency of the Advisory Vote on Executive Compensation in the absence of timely instructions for the beneficial owners; however brokers will have discretionary authority to vote on Proposal No. 4, Ratification of Appointment of Auditors . As a consequence, there will be no broker non-votes with regard to Proposal No. 4.

You may vote “FOR” or “WITHHOLD AUTHORITY” for each director nominee. If you vote “WITHHOLD AUTHORITY,” your vote will be counted for purposes of determining the presence of a quorum. You may vote “FOR”, “AGAINST” or “ABSTAIN” on the Company’s proposals to approve, on an advisory basis, its executive compensation and to ratify the selection of our independent registered public accounting firm. In connection with the Company's advisory vote on the frequency of the advisory vote on executive compensation, you may vote in favor of having the advisory vote on executive compensation once every "ONE YEAR", "TWO YEARS", OR "THREE YEARS".

The Company, as provided in and by its Certificate of Incorporation, has two authorized classes of common stock, denominated Common Stock and Class A Common Stock, and one authorized class of preferred stock, denominated Preferred Stock.

As of June 5, 2013, the record date for the Annual Meeting, there were 6,086,740 shares of Common Stock and 967,702 shares of Class A Common Stock outstanding. There are no outstanding shares of Preferred Stock.

Holders of Common Stock and holders of Class A Common Stock are entitled to one vote for each share of stock held, and the voting and other rights of each class are equivalent, except in respect to the election of directors. The Class A Common Stock shareholders have the right to elect four directors and the Common Stock shareholders have the right to elect three directors.

A quorum, counting proxies and shares represented in person, is necessary to the voting upon proposals proposed by management, and other business that may properly come before the Annual Meeting. The presence at the meeting, in person or by proxy, of the holders of a majority of the outstanding shares of Common Stock is a quorum for the election of directors to be elected by the holders of Common Stock, and the presence at the meeting, in person or by proxy, of the holders of a majority of the outstanding shares of Class A Common Stock is a quorum for the election of directors to be elected by holders of Class A Common Stock. For matters on which the shareholders vote together as a single class, the presence at the meeting, in person or by proxy, of the holders of a majority of all outstanding shares constitutes a quorum.

Election of directors is by a plurality vote of the respective class. Approval, on an advisory basis, of the Company's executive compensation and ratification of the appointment of the Company’s independent registered public accountants requires the affirmative vote of the holders of a majority of the shares represented in person or by proxy and entitled to vote on the proposals. In connection with the Company's advisory vote on the frequency of the advisory vote on executive compensation, the Board has determined that the frequency which receives the highest number of votes cast by shareholders will be viewed as representing the frequency which shareholders believe should be chosen by the Board.

How to Vote:

You may vote in person at the Annual Meeting, by telephone, internet or by proxy. Even if you plan to attend the Annual Meeting, we encourage you to vote by following the internet or telephone voting instructions on the the enclosed proxy voting instructions in advance of the Annual Meeting or by completing, signing and returning your proxy card.

In Person:

If you plan to attend the Annual Meeting and wish to vote in person, we will give you a ballot at the Annual Meeting. If your shares are held in the name of a broker or other nominee, we will allow you to attend the Annual Meeting upon presentation from the brokerage company an account statement, letter or other evidence satisfactory to us of your beneficial ownership of the shares. However, in order to vote in person at the meeting, you must obtain a proxy from your broker or other nominee, and bring that proxy to the meeting.

Internet:

To vote online, go to http:voteproxy.com as set forth on the enclosed proxy voting instructions and follow the on-screen instructions. You will need the control number on the enclosed proxy voting instructions to vote online. You may vote online until 11:59PM EST the day before the meeting.

Telephone:

To vote by telephone, call toll-free 1-800-776-9437 in the United States or 1-718-921-8500 from foreign countries from any touch-tone telephone and follow the instructions. You will need the control number on the enclosed proxy voting instructions to vote by telephone. You may vote by telephone until 11:59PM EST the day before the meeting.

Mail:

To vote by mail, please send your completed, signed and dated proxy card in the enclosed postage-paid return envelope as soon as possible.

Revocation:

You have the power to revoke your proxy at any time before its exercise. Thus, it may be revoked prior to its exercise by the filing of an instrument of revocation, or a duly executed proxy bearing a later date, with the Secretary of the Company at the Company’s principal executive office or by entering new instructions by internet or telephone. You can also revoke a filed proxy by attending the meeting and voting in person.

The following table sets forth certain information regarding the ownership of the Company’s Common Stock, Class A Common Stock and beneficial ownership of all shares outstanding as of May 22, 2013 by (i) each of the directors and director nominees named herein, (ii) each of the named executive officers listed in the summary compensation table and (iii) all current officers and directors as a group. Other than as noted below, the Company is not aware of any person, who, or as group which, beneficially owns more than five percent (5%) of any class of the Company’s equity securities as of May 22, 2013. Unless otherwise indicated, each of the shareholders has sole voting and investment power with respect to the shares owned (subject to community property laws, where applicable), and is the beneficial owner of them.

|

| | | | | | | | | | | | |

Beneficial Ownership of Equity Securities |

| | | | | |

| |

| | |

| | Number of Shares Owned | | Ownership Percentage of | | Ownership Percentage of | | Ownership Percentage of |

| | | | Class A | | Common Stock | | Class A Stock | | All Shares |

Name | | Common Stock | | Common Stock | | Outstanding (2) | | Outstanding (1) | | Outstanding |

| | | | | | | | | | |

David Edell (1) | | 146,609 |

| | 484,615 |

| | 2.4% | | 50.1% | | 8.9% |

Ira Berman | | 160,533 |

| | 483,087 |

| | 2.6% | | 49.9% | | 9.1% |

Sardar Biglari (2) | | 776,259 |

| | — |

| | 12.8% | | —% | | 11.0% |

Philip L. Cooley | | — |

| | — |

| | —% | | —% | | —% |

Stanley Kreitman | | 14,200 |

| | — |

| | * | | —% | | * |

Robert Lage | | — |

| | — |

| | —% | | —% | | —% |

Jonathan Rothschild | | 241,521 |

| | — |

| | 4.0% | | —% | | 3.4% |

Drew Edell | | 98,108 |

| | — |

| | 1.6% | | —% | | 1.4% |

Stephen A. Heit | | 2,627 |

| | — |

| | * | | —% | | * |

| | | | | | | | | | |

Officers & Directors | | | | | | | | | | |

As a Group (8 persons) | | 1,279,324 |

| | 484,615 |

| | 21.0% | | 50.1% | | 25.0% |

| | | | | | | | | | |

* Represents less than one percent (1%) of the outstanding shares of the class. |

(1) David Edell is a director of the Company and was re-appointed Chief Executive Officer of the Company on February 10, 2013. The address of David Edell and Ira Berman is 200 Murray Hill Parkway, East Rutherford, New Jersey 07073.

(2) Based on information contained in Schedule 13-D/A filed on August 8, 2011 with the SEC by Biglari Holdings Inc. The amount reported includes 388,130 shares held by Biglari Holdings Inc. Sardar Biglari is the Chairman and Chief Executive Officer of Biglari Holdings Inc. and has investment discretion over the securities owned by Biglari Holdings Inc. By virtue of this relationship, Sardar Biglari may be deemed to beneficially own the 388,130 shares owned directly by Biglari Holdings Inc. Sardar Biglari expressly disclaims beneficial ownership of such shares except to the extent of his pecuniary interest therein. The amount reported also includes 388,129 shares held by the The Lion Fund, L.P. (“The Lion Fund”). Biglari Capital Corp. (“BCC”) is the general partner of The Lion Fund and is a wholly-owned subsidiary of Biglari Holdings Inc. Sardar Biglari is the Chairman and Chief Executive Officer of BCC and has investment discretion over the securities owned by The Lion Fund. By virtue of these relationships, BCC, Biglari Holdings Inc. and Sardar Biglari may be deemed to beneficially own the 388,129 shares owned directly by The Lion Fund. Each of BCC, Biglari Holdings Inc. and Sardar Biglari expressly and respectively disclaims beneficial ownership of such shares except to the extent of their respective pecuniary interest therein. The

principal business address of each of Biglari Holdings Inc., Sardar Biglari, BCC and The Lion Fund is 17802 IH 10 West, Suite 400, San Antonio, Texas 78257.

Mr. Stephen A. Heit is an officer. Mr. Drew Edell is a director and an officer. Messrs. Biglari, Cooley, Kreitman, Lage, and Rothschild are independent, outside directors. James P. Mastrian resigned as a director, effective August 15, 2012.

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires our executive officers and directors and beneficial owners of more than ten percent of the Company's Common Stock to file reports regarding ownership of the Company's Common Stock with the SEC, and to furnish the Company with copies of all such filings. Based solely on a review of these filings, the Company believes that all of the following filings were not timely made in fiscal 2012: one Form 4 for Stephen A. Heit that was filed late on June 6, 2013 to report five small acquisitions of common stock pursuant to a Rule 10b-5-1 dividend reinvestment plan, and one Form 3 for Jonathan Rothschild was filed late on October 22, 2012.

The following individuals are the current executive officers of the Company:

Chief Executive Officer: David Edell, 81 years old, served as the Company's Chief Executive Officer until November 30, 2010 and was re-appointed Chief Executive Officer on February 10, 2013 following the death of Dunnan D. Edell, our former CEO. Mr. Edell also serves as a director of the Company. From January 1, 2011 to February 10, 2013 he served as a consultant to the Company under an agreement that provided for a five year term that commenced January 1, 2011. Prior to his association with the Company, he was a marketing and financial consultant; and, by 1983, he had extensive experience in the health and beauty aids field as an executive director and/or officer of Hazel Bishop, Lanolin Plus and Vitamin Corporation of America. In 1954, David Edell received a Bachelor of Arts degree from Syracuse University. Because Mr. Edell did not serve as an executive officer of the Company during fiscal 2012, he is not included in the Summary Compensation Table below.

President and Chief Financial Officer: Stephen A. Heit, 58 years old, joined CCA in May 2005 as Executive Vice President – Operations, and was appointed Chief Financial Officer in March 2006. Prior to that he was Vice President – Business Strategies for Del Laboratories, Inc., a consumer products company that was listed on the American stock exchange, from 2003 to 2005. Mr. Heit served as President of AM Cosmetics, Inc. from 2001 to 2003, as Chief Financial Officer from 1998 to 2003, and Corporate Secretary to the Board of Directors from 1999 to 2003. From 1987 to 1997 he was the Chief Financial Officer of Pavion Limited, and also served on the Board of Directors. He also served as a Director of Loeb House, Inc., a non-profit organization serving mentally handicapped adults from 1987 to 1995, and Director of Nyack Hospital Foundation from 1993 to 1995. He received a Bachelor of Science from Dominican College in 1976, with additional graduate work in professional accounting at Fordham University, and an MBA in accounting from the University of Connecticut School of Business.

Chief Operating Officer and Director –Drew Edell, 55 years old, was appointed Chief Operating Officer of the Company in February 2013. He was appointed as a director of the Company on February 10, 2013 to fill the remaining term of Dunnan Edell. Mr. Edell is a graduate of Pratt Institute, where he received a Bachelor’s degree in Industrial Design. Mr. Edell joined the Company in 1983 and he served as Vice President of Product Development and Production from 1985 until his appointment as Chief Operating Officer. Mr. Edell has also served as the Corporate Secretary since December 2010.

Summary Compensation Table

The following table summarizes compensation earned in the 2012, 2011 and 2010 fiscal years by the Company's named executive officers for fiscal 2012:

|

| | | | | |

Name and Principal Position | Year | Salary ($) | Bonus ($) (1) | All Other Compensation ($) (2) | Total ($) |

Dunnan D. Edell (3) | 2012 | 350,000 | 50,000 | 24,953 | 424,953 |

Former Chief | 2011 | 350,000 | 100,000 | 22,735 | 472,735 |

Executive Officer | 2010 | 350,000 | 64,000 | 17,977 | 431,977 |

Stephen A. Heit | 2012 | 250,000 | --- | 28,513 | 278,513 |

President, | 2011 | 250,000 | 40,000 | 21,310 | 311,310 |

Chief Financial Officer | 2010 | 250,000 | 23,333 | 12,709 | 286,042 |

Drew Edell | 2012 | 275,000 | --- | 22,690 | 297,690 |

Chief Operating | 2011 | 275,000 | 40,000 | 21,703 | 336,703 |

Officer | 2010 | 275,000 | 32,000 | 17,140 | 324,140 |

| |

(1) | Bonus amounts represent amounts earned in each respective fiscal year, not necessarily paid in each year. |

| |

(2) | Includes the personal use value of Company leased automobiles, the value of Company‑provided life insurance, and health insurance that is made available to all employees. Please see "Employment Contracts/Compensation Program" below for further information regarding the compensation of Dunnan D. Edell, Stephen A. Heit and Drew Edell. |

| |

(3) | Dunnan D. Edell died on February 9, 2013. |

Executive Compensation Principles - Compensation Committee

The Company's executive compensation program is based on guiding principles designed to align executive compensation with Company values and objectives, business strategy, management initiatives, and financial performance. In applying these principles the Compensation Committee of the Board of Directors, comprised of Philip Cooley, Stanley Kreitman, Robert Lage and Jonathan Rothschild has established a program intended to:

| |

• | Reward executives for long‑term strategic management and the enhancement of shareholder value. |

| |

• | Integrate compensation programs with both the Company's annual and long‑term strategic planning. |

| |

• | Support a performance‑oriented environment that rewards performance not only with respect to Company goals but also Company performance as compared to industry performance levels. |

The Compensation Committee has a charter, which may be found in the investor section of the Company's web site, www.ccaindustries.com under Corporate Governance. Compensation, including annual bonus amounts, for the executive officers named in the Summary Compensation Table (other than the Chief Executive Officer), are recommended by the Chief Executive Officer, and approved by the Compensation Committee and the Board of Directors.

Outstanding Equity Awards at 2012 Fiscal Year End

None of our named executive officers had any outstanding equity awards as of the end of fiscal 2012. There were no stock options granted or options exercised during fiscal 2012.

Employment Contracts/Compensation Program

The Compensation Committee (the "Committee") determines the level of salary and bonuses, if any, for key executive officers of the Company. The Committee determines the salary or salary range based upon competitive norms. Actual salary changes are based upon performance, and bonuses are reviewed and recommended by the Committee for approval by the Board in consideration of the employee's performance during the fiscal year and, except for the Company's Chief Executive Officer, upon the recommendation of the Company's Chief Executive Officer.

On March 21, 2011, the Committee, acting on behalf of the Company, entered into an Employment Agreement (each, an “Employment Agreement”) with each of Dunnan Edell, Stephen A. Heit, and Drew Edell (each, an “Executive”). Pursuant their respective Employment Agreements, Mr. Dunnan Edell was engaged to continue to serve as the Company's President and Chief Executive Officer, Mr. Heit was engaged to continue to serve as the Company's Executive Vice President and Chief Financial Officer, and Mr. Drew Edell was engaged to continue to serve as the Company's Executive Vice President, Product Development and Production. Dunnan Edell died on February 9, 2013. Stephen A. Heit was appointed President of the Company in addition to his responsibilities as Chief Financial Officer and Drew Edell was appointed Chief Operating Officer, effective February 10, 2013.

Mr. Drew Edell is the son of David Edell, who is a member of the Board of Directors of the Company and served as a consultant to the Company until his re-appointment as Chief Executive of the Company on February 10, 2013. Except as set forth below, the Employment Agreements contain substantially similar terms to each other. The term of employment under each of the Employment Agreements runs from March 21, 2011 through December 31, 2013, and will continue thereafter for successive one-year periods unless the Company or the Executive chooses not to renew the respective Employment Agreement.

Under the respective Employment Agreements, the base salaries of Mr. Dunnan Edell, Mr. Heit, and Mr. Drew Edell (the “Executives”) are $350,000, $250,000, and $275,000 per annum, respectively, and may be increased each year at the discretion of the Company's Board of Directors. The Executives are eligible to receive an annual performance-based bonus under their respective Employment Agreement, and are entitled to participate in Company equity compensation plans. In addition, each of the Executives will receive an automobile allowance, health insurance and certain other benefits. In the event of termination of the respective Employment Agreement as a result of the disability or death of the Executive, the Executive (or his estate or beneficiaries) shall be entitled to receive all base salary and other benefits earned and accrued until such termination as well as a single-sum payment equal to the Executive's base salary and a single-sum payment equal to the value of the highest bonus earned by the Executive in the one-year period preceding the date of termination pro-rated for the number of days served in that fiscal year. If the Company terminates the Executive for Cause (as defined in the respective Employment Agreement), or the Executive terminates his employment in a manner not considered to be for Good Reason (as defined in the respective Employment Agreement), the Executive shall be entitled to receive all base salary and other benefits earned and accrued prior to the date of termination. If the Company terminates the Executive in a manner that is not for Cause or due to the Executive's death or disability, the Executive terminates his employment for Good Reason, or the Company does not renew the Employment Agreement after December 31, 2013, the Executive shall be entitled to receive a single-sum payment equal to his unpaid base salary and other benefits earned and accrued prior to the date of termination and a single-sum payment of an amount equal to three times (a) the average of the base salary amounts paid to Executive over the three calendar years prior to the date of termination, (b) if less than three years have elapsed between March 21, 2011 and the date of termination, the highest base salary paid to the Executive in any calendar year prior to the date of termination, or (c) if less than twelve months have elapsed between March 21, 2011 and the date of termination, the highest base salary received in any month times twelve. In addition, each Executive is entitled to the same benefits if he terminates his employment with the Company in connection with a Change of Control (as defined in their respective Employment Agreements).

Under the Employment Agreements, each Executive has agreed to non-competition restrictions for a period of six months following the end of the term of his Employment Agreement, during which period the Executive will be paid an amount equal to his base salary for a period of six months, and an amount equal to the pro rata share of any bonus attributable to the portion of the year completed prior to the date of termination. The Executives have also agreed to confidentiality and non-solicitation restrictions under the Employment Agreements.

The foregoing summary of the Employment Agreements are qualified in their entirety by the full text of the Employment Agreements, copies of which may be found in Form 8-K that was filed by Company on March 21, 2011

with the United States Securities and Exchange Commission.

The Company also entered into an Employment Agreement with another Company executive, who is not a “named executive officer” within the meaning of the Securities Exchange Act of 1934, as amended and related regulations. The additional Employment Agreement referred to in the preceding sentence contains substantially similar terms as the Employment Agreements discussed above, except that the employee's base salary is $135,000 per annum.

Equity Plans

Long‑term incentives may be provided through the issuance of stock options or other equity awards, as determined in the discretion of the Board of Directors.

On June 15, 2005, the shareholders approved an amended and Restated Stock Option Plan amending the 2003 Stock Option Plan (the “Plan”). The Plan authorizes the issuance of up to one million shares of common stock (subject to customary adjustments set forth in the plan) pursuant to equity awards, which may take the form of incentive stock options, nonqualified stock options restricted shares, stock appreciation rights and/or performance shares. No such grants were issued in fiscal 2012.

Awards may be granted under the Plans to employees (including officers and directors who are also employees) of the Company provided, however, that Incentive Stock Options may not be granted to any non‑employee director or consultant.

The Plan is administered and interpreted by the Board of Directors. (Where issuance to a Board member is under consideration, that member must abstain.) The Board has the power, subject to plan provisions, to determine the persons to whom and the dates on which awards will be granted, the amount and vesting or exercise provisions of awards, and other terms. The Board has the power to delegate administration to a committee of not less than two (2) Board members, each of whom must be a “non-employee director” within the meaning of Rule 16b‑3 under the Securities Exchange Act. Members of the Board receive no compensation for their services in connection with the administration of option plans.

The Plan permits the exercise of options for cash, or such other method as the Board may permit from time to time. The maximum term of each option is ten (10) years. No option granted is transferable by the optionee other than upon death.

The exercise price of all options must be at least equal to one hundred percent (100%) of the fair market value of the underlying stock on the date of grant. The aggregate fair market value of stock of the Company (determined at the date of the option grant) for which any employee may be granted Incentive Stock Options in any calendar year may not exceed $100,000, plus certain carryover allowances. The exercise price of an Incentive Stock Option granted to any participant who owns stock possessing more than ten percent (10%) of the voting rights of the Company's outstanding capital stock must be at least one hundred-ten percent (110%) of the fair market value on the date of grant. As of November 30, 2012, there were no outstanding stock options.

Retirement Benefits

The Company has adopted a 401(K) Profit Sharing Plan that covers all employees with over one year of service and attained age 21, including the executive officers named in the Summary Compensation Table. Employees may make salary reduction contributions up to twenty-five percent of compensation not to exceed the federal government limits. The Plan allows for the Company to make discretionary contributions. For all fiscal periods reflected in the Summary Compensation Table, the Company did not make any contributions.

Board Leadership Structure

The Chairman of the Board of Directors is Stanley Kreitman, who is an independent director, and the Chief Executive Officer of the Company is David Edell, who also serves as a director. Stephen A. Heit serves as President and Chief Financial Officer, and Drew Edell serves as Corporate Secretary. There is no lead independent director, however, Robert Lage, an independent director, serves as Chairman of the Audit and Compensation Committees. The Company has had separate positions of Chairman of the Board and Chief Executive Officer since its inception.

The Board of Directors consists of seven members, five of whom are independent. Members of the Board of Directors are kept informed of the Company’s operations by reviewing materials provided to them, visiting the Company’s offices, speaking to the executives of the Company and by attending meetings of the Board and its committees. A meeting is held at least once per year with only the independent directors in attendance.

The Board of Director’s leadership is designed so that the independent directors exercise oversight over the Company’s key issues related to strategy and risk. A detailed annual budget is presented and approved by the directors, including plans for media expenditures. Revised forecasts for the fiscal year are presented to the directors as circumstances dictate.

Risk Oversight

The Company does not have a risk management committee. Risk oversight is performed by the entire Board of Directors. The Board considers risk levels in various areas of operation of the Company, including, but not limited to, legal and litigation issues, investments in marketable securities, accounts receivable and inventory levels, returns of product, and proposed new products. Robert Lage, the Chairman of the Audit Committee, is in regular communication with Stephen A. Heit, the Company’s President and Chief Financial Officer, reviewing the Company’s internal controls, compliance with the Sarbanes-Oxley Act, the Company’s financial results and compliance with the Company’s Standard of Business Conduct. All employees, including the executive officers, are required to comply with the Company’s Standard of Business Conduct. A copy of the Standard of Business Conduct is available under Corporate Governance in the Investor Relations section of the Company website www.ccaindustries.com. The Board believes that the close oversight by members of the Board over the Company and its management provides effective risk management of the Company’s operations.

Code of Conduct

The Company has adopted Standard of Business Conduct (our code of ethics), which apply to all directors and employees of the Company, including the Chief Executive Officer, Chief Financial Officer, Chief Operating Officer and Controller. A copy of the Standard of Business Conduct may be found in the investor section of the Company’s web site, www.ccaindustries.com, under Corporate Governance. The Company intends to disclose any substantive amendments to the Standard of Business Conduct as well as any waivers from provisions with respect to our Chief Executive Officer, Chief Financial Officer, Chief Operating Officer, Controller, any principal accounting officer, and any other executive officer or director at the same web site location.

Director Independence

Stanley Kreitman, Sardar Biglari, Philip L. Cooley, Jonathan Rothschild, and Robert Lage are deemed by the Board of Directors to be “independent” members of the Board of Directors, as determined in accordance with Section 803(a) of the NYSE Amex stock exchange rules and by regulations of the SEC.

There were no related party transactions that occurred between the Company and any of the independent directors, and there were no transactions, relationships or arrangements not disclosed under “Transactions with Related Persons” that were considered by the Board under the applicable independence definitions in determining that the director is independent.

Board Meetings

During fiscal year 2012, the Board of Directors held five meetings (four times in person and one additional time by conference call), the Audit Committee held four meetings, the Compensation Committee held one meeting, the Nominating Committee held one meeting, and the Investment Committee held four meetings. All of the directors attended 100% of all of the meetings of the Board and at least 75% of the respective committee meetings of the Board of which they were members.

All of the Company’s directors were present at the last annual meeting. The Company does not have a policy with regards to directors’ attendance at annual shareholder meetings.

Committees of the Board

The following chart shows the standing committees of the Board of Directors and their members:

|

| | | |

| AUDIT | COMPENSATION | NOMINATING |

Sardar Biglari | X | | |

Philip L. Cooley | X | X | X |

David Edell | | | |

Drew Edell | | | |

Stanley Kreitman | X | X | X |

Robert Lage | X | X | |

Jonathan Rothschild | X | X | X |

Audit Committee

The Company has an Audit Committee comprised solely of independent directors. Mr. Lage serves as Chairman of the Audit Committee. Robert Lage, a retired certified public accountant, Sardar Biglari, Philip L. Cooley, and Stanley Kreitman, a former president of a national bank, are deemed by the Board of Directors to be “audit committee financial experts” as defined by the SEC rules and are “financially sophisticated” as defined by NYSE-Amex rules.

The Audit Committee is appointed by the Board to assist the Board with oversight of (i) the integrity of the financial statements of the Company, (ii) the Company’s compliance with legal and regulatory requirements, (iii) the independence and qualifications of the Company’s external auditors, and (iv) the performance of the Company’s internal audit function and external auditors. It is the Audit Committee’s responsibility to select, retain or terminate the Company’s independent registered public accountants, who audit the Company’s financial statements, and to prepare the Audit Committee report that the SEC requires to be included in the Company’s Annual Proxy Statement. As part of its activities, the Audit Committee meets with the Company’s independent registered public accountants at least annually to review the scope and results of the annual audit and quarterly to discuss the review of the quarterly financial results. In addition, the Audit Committee receives and considers the independent registered public accountants’ comments and recommendations as to internal controls, accounting staff, management performance and auditing procedures. The Audit Committee is also responsible for establishing procedures for (i) the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls and auditing matters and (ii) the confidential, anonymous submission by employees of the Company of concerns regarding questionable accounting or auditing matters.

Regarding fiscal 2012, the Audit Committee (a) reviewed and discussed the Company’s audited financial statements with management; (b) received and discussed the information required to be discussed, pursuant to auditing standards and SEC regulations with the Company’s independent auditors; (c) received written disclosures, and the letter concerning same, from the independent auditors as required by the Public Company Accounting Oversight Board; (d) discussed the independence of the auditors, with the auditors; and (e) recommended that the audited financial statements be included in the Company’s Annual Report on Form 10-K.

An Audit Committee Charter was adopted by the full Board of Directors. A copy of the Audit Committee Charter can be found in the investor relations section of the Company’s website at www.ccaindustries.com.

Compensation Committee

Mr. Lage serves as Chairman of the Compensation Committee.

The functions of the Compensation Committee include evaluating the performance of the Chief Executive Officer, and other executive officers of the Company, and, based on this evaluation, reviewing and recommending to the Board the compensation of the Chief Executive Officer and the Company’s other executive officers; making recommendations to the Board of Directors with respect to compensation of non-management directors; determining and administering, the Company’s compensation plans; and performing other related functions specified in the Committee’s charter.

A Compensation Committee Charter was adopted by the full Board of Directors. The charter was amended by the Board of Directors on May 23, 2011. A copy of the amended Committee Charter can be found in the investor relations section of the Company’s web site at www.ccaindustries.com.

Nominating Committee

Stanley Kreitman serves as Chairman of the Nominating Committee. There is no charter for the Nominating Committee.

The Nominating Committee’s responsibilities include, among other things, identifying individuals qualified to become Board members and recommending to the Board nominees to stand for election at any meeting of shareholders, and identifying and recommending nominees to fill any vacancy, however created, in the Board.

Nominees for director are selected on the basis of broad experience and diversity, which includes differences of viewpoint, professional experience, education, skill and other individual qualities. In addition, integrity, the ability to make independent analytical inquiries, an understanding of the Company’s business environment with particular emphasis on consumer products and the Company’s retail partners, and a willingness to devote adequate time to Board of Director duties are also considered. The Committee may consider candidates proposed by management or shareholders but is not required to do so. Except as described in the next paragraph, the Committee does not have any formal policy with regard to the consideration of any director candidates recommended by the security holders or any minimum qualifications or specific procedure for identifying and evaluating nominees for director as the Board does not believe that such a formalistic approach is necessary or appropriate at this time.

Shareholders who wish to recommend candidates for consideration by the Nominating Committee for Board membership may do so by writing to CCA Industries Inc., Attention: Nominating Committee, 200 Murray Hill Parkway, East Rutherford, NJ 07073. To be considered for the 2014 Annual Meeting, such recommendations must be received by the Company no earlier than March 20, 2014 and no later than April 19, 2014. Any such proposal shall contain the name, Company security holdings and contact information of the person making the nomination; the candidate's name, address and other contact information; any direct or indirect holdings of the Company's securities by the nominee; any information required to be disclosed about directors under applicable securities laws and/or stock exchange requirements; information regarding related party transactions with the Company and/or the shareholder submitting the nomination; any actual or potential conflicts of interest; the nominee's biographical data, current public and private company affiliations, employment history and qualifications and status as "independent" under applicable securities laws and stock exchange requirements as well as any other information required to be provided for shareholder nominations under to Section 2.5 of the Company’s Amended and Restated Bylaws. Director candidates recommended by shareholders will receive the same consideration as other nominees.

Communications with Directors

Shareholders of the Company who wish to communicate with the Board or any individual director can write to CCA Industries, Inc., Investor Relations, 200 Murray Hill Parkway, East Rutherford, NJ 07073 or send an email to boardofdirectors@ccaindustries.com. Your letter or email should indicate that you are a shareholder of the Company. Depending on the subject matter of your inquiry, management will forward the communication to the director or directors to whom it is addressed; attempt to handle the inquiry directly, as might be the case if you request information about the Company or it is a shareholder related matter; or not forward the communication if it is primarily commercial in nature or if it relates to an improper topic. At each Board meeting, a member of management presents a summary of all communications received since the last meeting that were not forwarded and makes those communications available to any requesting director.

The Company’s policy regarding transactions with related persons requires transactions with related persons to be reviewed and approved or ratified by the Company’s Audit Committee as well as by the Company’s Chief Executive Officer and Chief Financial Officer. In this regard, all such transactions are first discussed with the Chief Executive Officer and the Chief Financial Officer for an initial determination of whether such further related person transaction review is required. The Company utilizes the definition of related persons under applicable SEC rules, defined as any executive officer, director or nominee for director of the Company, any beneficial owner of more than 5% of the outstanding shares of the Company’s common stock, or any immediate family member of any such person. In reviewing these transactions, the Company strives to assure that the terms of any agreement between the Company and a related party is at arm’s length, fair and at least as beneficial to the Company as could be obtained from third parties. The Audit Committee, in its discretion, may consult with third party appraisers, valuation advisers or brokers to make such determination.

During fiscal 2012 and 2011, as per their respective Employment Agreements, the Company made payments of $687,222 and $648,625 each to David Edell and Ira Berman for consulting services provided during those years and also paid life insurance policy premiums totaling $55,786 and $55,786, respectively for policies owned by David Edell and Ira Berman. In addition, in March 2011, the Company entered into Change of Control Agreements with each of David Edell and Ira Berman, which could result in payments to such persons in the event of a Change of Control (as defined in the Change of Control Agreements), including a lump sum payment of all fees under the applicable Employment/Consulting Agreement from the date of occurrence of the Change of Control through the end of the original term of such agreement; vesting of awards under the Company's equity-based compensation plans, if any; and a gross-up payment so that the after tax value of the applicable consultant's payments and benefits under the Change of Control Agreement would be the same as though no excise taxes applied to such payments or benefits. Both of David Edell and Ira Berman served as executives of the Company in fiscal 2010 and are each currently beneficial owners of greater than 5% of the Company’s voting securities. David Edell currently serves as the Chief Executive Officer and a director of the Company and Mr. Berman served as director of the Company during fiscal 2011.

The Company has not entered into any other transactions, other than as disclosed above, since the beginning of the Company’s last two fiscal years, or has proposed to enter into any transaction, other than as disclosed above, in which any related person had or will have a direct or indirect material interest.

The seven directors named herein are nominated to be elected to the Company’s Board of Directors. All directors are subject to one-year terms and annual election. Four directors are elected by the holders of Class A Common Stock and three directors are elected by the holders of Common Stock. Each director holds office until the next Annual Meeting of Shareholders and until a successor is elected and qualified, or until death, resignation or removal. Each of the director nominees has agreed to be named in this proxy statement and to serve if elected. Management has no reason to believe that any of the nominees will be unable or unwilling for good cause to serve if elected. However, if any nominee should become unable for any reason or unwilling for good cause to serve, proxies may be voted, to the extent permitted by applicable law, for another person nominated as a substitute by the Board.

The four nominees for election by the holders of the Company’s Class A Common Stock are David Edell, Robert A. Lage, Jonathan Rothschild, and Stanley Kreitman and are current directors. The three nominees for election by the holders of Common Stock are Sardar Biglari, Philip L. Cooley, and Drew Edell and are current directors and were recommended for election by the Nominating Committee of the current Board of Directors. Drew Edell was appointed a director in February 2013 by the directors elected by the holders of the Common Stock to fill the vacancy created by the death of Dunnan Edell.

There were no arrangements or understandings between any director or nominee for director and any other person pursuant to which such person was selected as a director or nominee for director. There are no family relationships among any of the directors or executive officers or nominees for director or executive officer, except that David Edell, the Chief Executive Officer and a director, is the father of Drew Edell, the Chief Operating Officer and a director.

The following table summarizes information with respect to the nominees:

|

| | |

Name | Age | Director Since |

Class A Common Stock Nominees: | | |

David Edell | 81 | 1983 |

Stanley Kreitman | 80 | 1996 |

Robert A. Lage | 76 | 2003 |

Jonathan Rothschild | 59 | 2012 |

Common Stock Nominees: | | |

Sardar Biglari | 35 | 2011 |

Philip L. Cooley | 69 | 2011 |

Drew Edell | 55 | 2013 |

Set forth below is additional information regarding all nominees for director, including information concerning their principal occupations and certain other directorships.

Class A Common Stock Nominees

No vote or proxy is solicited in respect of the nominees to be elected by the holders of Class A Common Stock, since Messrs. Ira W. Berman and David Edell, own all of the shares of Class A Common Stock, and they have jointly proposed David Edell, Mr. Kreitman, Mr. Lage and Mr. Rothschild for re-election.

David Edell

David Edell is the Chief Executive Officer and a director of the Company. Mr. Edell served as the Company's Chief Executive Officer until November 30, 2010 and was re-appointed Chief Executive Officer on February 10, 2013 following the death of Dunnan D. Edell, our former CEO. From January 1, 2011 to February 10, 2013, David Edell served as a consultant to the Company under an agreement that provided for a five year term that commenced on January 1, 2011. Prior to his association with the Company, he was a marketing and financial consultant; and, by 1983, he had extensive experience in the health and beauty aids field as an executive director and/or officer of Hazel Bishop, Lanolin

Plus and Vitamin Corporation of America. In 1954, David Edell received a Bachelor of Arts degree from Syracuse University. Mr. Edell is the father of Drew Edell.

Director Qualifications

| |

• | Extensive experience in the consumer products market segment |

| |

• | Founder of the Company and leadership role since inception |

Stanley Kreitman

Stanley Kreitman has been Chairman of the Board of the Company since 2011, and Vice Chairman of Manhattan Associates, an equity investment firm, since 1994. He is a director of Arbor Realty Trust, a NYSE listed company, and Medallion Financial Corp., a NASDAQ listed company. Within the last five years, Mr. Kreitman has held directorship positions at the following public companies: CapLease Inc. (formerly Capital Lease Financial Corp.) (NYSE), KSW, Inc. (listed on NASDAQ until its acquisition in 2012), Arbinet Corporation (listed on NASDAQ until its acquisition in 2011), and Sports Acquisition Corp. and Renaissance Acquisition Corp. each of which was a special purpose company. He also serves as a director of the New York City Board of Corrections, Nassau County Crime Stoppers, and serves on the board of the Police Athletic League. From 1975 to 1993 he was President of United States Banknote Corp. (NYSE), a securities printer.

Director Qualifications

| |

• | Leadership experience as President of United States Banknote Corporation |

| |

• | Extensive experience serving on boards of directors of various corporations and organizations |

| |

• | Deemed by the Board of Directors to be an “audit committee financial expert” as defined by the SEC rules and “financially sophisticated” as defined by the NYSE-Amex rules. |

Robert A. Lage

Robert A. Lage is a director of the Company, and a retired CPA. He was a partner at PricewaterhouseCoopers Management Consulting Service prior to his retirement in 1997. He has been engaged in the practice of public accounting and management consulting since 1959. He received a BBA from Bernard Baruch College of The City University of New York in 1958.

Director Qualifications

| |

• | Certified Public Accountant since 1959 |

| |

• | Extensive experience as a partner at PricewaterhouseCoopers Management Consulting Service |

| |

• | Deemed by the Board of Directors to be an “audit committee financial expert” as defined by the SEC rules and “financially sophisticated” as defined by NYSE-Amex rules |

Jonathan Rothschild

Jonathan Rothschild is a director of the Company. Mr. Rothschild has served as a director of Immucell, Inc., a NASDAQ listed biotechnology company, since 2001, and serves on its audit committee. He is President and sole owner of Arterio, Inc. which is in the vitamin and supplements business. Mr. Rothschild is also a director of the Anne Frank Center USA, a not-for-profit organization.

Director Qualifications

| |

• | Extensive experience in the supplements business |

| |

• | Director and member of audit committee of a NASDAQ listed company |

Common Stock Nominees

The Nominating Committee is proposing Sardar Biglari, Philip L. Cooley, and Drew Edell for election by the holders of Common Stock at the Annual Meeting.

Sardar Biglari

Sardar Biglari is a director of the Company. He has served as Chairman, since June 2008, Chief Executive Officer, since August 2008, and a director, since March 2008, of Biglari Holdings Inc., a diversified holding company, and Chairman and Chief Executive Officer of Biglari Capital Corp., a wholly-owned subsidiary of Biglari Holdings Inc. and general partner of The Lion Fund, L.P., a private investment fund, since its inception in 2000. He has also served as Chairman, since March 2006, Chief Executive Officer and President, since May 2007, and a director, since December 2005, of Western Sizzlin Corporation, a diversified holding company, which was acquired by Biglari Holdings Inc. in March 2010.

Director Qualifications

| |

• | Mr. Biglari has extensive managerial and investing experience in a broad range of businesses through his services as Chairman and Chief Executive Officer of Biglari Holdings Inc. and its major operating subsidiaries. |

| |

• | Experience serving on the boards of directors of public companies. |

Philip L. Cooley

Philip L. Cooley is a director of the Company. He has served as Vice Chairman of the Board of Biglari Holdings Inc. since April 2009 and as a director since March 2008. He was the Prassel Distinguished Professor of Business at Trinity University, San Antonio, Texas, from 1985 until his retirement in May 2012. Dr. Cooley served as an advisory director of Biglari Capital Corp., general partner of The Lion Fund, L.P., since 2000 and as Vice Chairman and a director of Western Sizzlin Corporation from March 2006 and December 2005, respectively, until its acquisition by Biglari Holdings Inc. in March 2010. Dr. Cooley earned a Ph.D. from Ohio State University, a MBA from the University of Hawaii and a BME from the General Motors Institute. Dr. Cooley is past president of the Eastern Finance Association, and serves on its board, and of the Southern Finance Association. He also serves on the board of the Consumer Credit Counseling Service of Greater San Antonio.

Director Qualifications

| |

• | Dr. Cooley has extensive business and investment knowledge and experience. |

| |

• | Experience serving on the boards of directors of public companies. |

| |

• | Author of more than 60 articles on financial topics, his work has appeared in the Journal of Finance, Journal of Business and others. He also has authored several books in finance. |

Drew Edell

Drew Edell, is a graduate of Pratt Institute, where he received a Bachelor’s degree in Industrial Design. Mr. Edell is the Chief Operating Officer effective February 10, 2013, and has served as Corporate Secretary since December 2010. He was appointed as a director of the Company on February 10, 2013 to fill the remaining term of Dunnan Edell who died on February 9, 2013. He joined the Company in 1983, and in 1985, he was appointed Vice President of Product Development and Production. Mr. Edell is the son of David Edell, who is a director and Chief Executive Officer of the Company.

Director Qualifications

| |

• | Extensive experience in the consumer products market segment |

| |

• | Employed with the Company since inception |

Required Vote

Directors are elected by the plurality of votes cast in person or by proxy, provided a quorum is present at the Annual Meeting. Accordingly, abstentions and broker non-votes will not affect the outcome of the election.

RECOMMENDATION OF THE BOARD OF DIRECTORS

The Board of Directors unanimously recommends a vote in favor of each of the Common Stock nominees as proposed in this Proposal No. 1.

DIRECTOR COMPENSATION

Each outside director was paid $2,500 for a conference call meeting and $5,000 per meeting for attendance in person at board meetings in fiscal 2012 (without additional compensation for committee meetings, other than as noted below). Effective August 4, 2011, the Board of Directors approved an annual retainer of $25,000 for each outside director, in addition to the conference call or in person meeting payments. The Board of Directors met four times in person during fiscal 2012, and one additional time by conference call, for an aggregate compensation of $288,750, not including Mr. Kreitman's additional compensation of $15,000 as Chairman of the Board, and Mr. Lage's additional compensation of $30,000 as chairman of the audit committee. No stock options were awarded.

The following table summarizes the fees earned or paid in cash to each director, with respect to their service as directors, during fiscal 2012:

|

| | | | | | | | |

| | Fees Earned or | | |

Name | | Paid in Cash ($) | | Total ($) |

Sardar Biglari | | $ | 47,500 |

| | $ | 47,500 |

|

Philip Cooley | | 47,500 |

| | 47,500 |

|

David Edell (1) | | 45,000 |

| | 45,000 |

|

Stanley Kreitman | | 62,500 |

| | 62,500 |

|

Robert Lage | | 77,500 |

| | 77,500 |

|

James Mastrian (2) | | 42,500 |

| | 42,500 |

|

Jonathan Rothschild (2) | | 11,250 |

| | 11,250 |

|

| |

(1) | David Edell also received $687,222 for consulting services as per his Employment Agreement, and $33,185 was paid in life insurance premiums for policies owned by Mr. Edell. |

| |

(2) | James Mastrian resigned as a director of the Company, effective August 15, 2012. Jonathan Rothschild was appointed as director of the Company, effective the same date. |

Board members who are also officers are not separately compensated for their services as directors.

The Company is required to submit a proposal to its shareholders for a non-binding advisory vote to approve the compensation of its named executive officers pursuant to Section 14A of the Exchange Act. The shareholder vote on executive compensation is an advisory vote only and is not binding on the Company or the Board of Directors.

Although the vote is non-binding, the Compensation Committee and the Board of Directors value the opinions of our shareholders and intend to consider the outcome of the vote when making future compensation decisions. This proposal, commonly known as a “say-on-pay” proposal, gives the Company's shareholders an opportunity to express their views on the compensation of the Company's named executive officers as described in this proxy statement under the heading "Executive Compensation."

Accordingly, the following resolution is submitted for shareholder vote at the Annual Meeting:

“RESOLVED, that the Company's shareholders approve, on an advisory basis, the compensation paid to the Company's named executive officers, as disclosed pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the compensation tables and narrative discussion.”

The approval, on an advisory basis, of the Company's executive compensation requires the affirmative vote of a majority of the Company's outstanding shares present in person or by proxy and entitled to vote, provided a quorum is present at the Annual Meeting. Abstentions will be counted for the purpose of meeting the quorum requirements and will have the same effect as a vote against the approval of this proposal.

RECOMMENDATION OF THE BOARD OF DIRECTORS

The Board of Directors unanimously recommends a vote in favor of Proposal No. 2.

Section 14A of the Exchange Act also provides that the Company's shareholders must be given the opportunity, at least once every six years, to cast an advisory vote on how frequently the Company should seek future advisory votes on the compensation of its named executive officers.

Under this Proposal No. 3, shareholders may vote to have the say-on-pay vote every year, every other year or every three years. Shareholders also may, if they wish, abstain from voting on this proposal.

Because this vote is advisory, it will not be binding upon the Board of Directors. However, the Board of Directors values the opinions expressed by shareholders in these votes and will take into account the outcome of the vote when determining how frequently the advisory vote on the Company's executive compensation should be conducted in the future.

After careful consideration, the Board of Directors has determined that an advisory vote on executive compensation every three years is the best approach for the Company, and therefore the Board of Directors recommends that shareholders vote every “three years” to approve, on an advisory basis, the Company's executive compensation. The Board of Directors believes that a vote on the Company's executive compensation once every three years will provide the Company with more time to meaningfully respond to shareholder vote results and implement any changes to our executive compensation policies and procedures that the Compensation Committee and Board of Directors may feel are necessary or appropriate in light of the results of the most recent shareholder vote. In addition, the Board of Directors feels that a triennial vote will provide investors with sufficient time to evaluate the effectiveness of our executive compensation program as it relates to the business outcomes of the Company.

It is important to note that shareholders are not voting to approve or disapprove the recommendation of the Board of Directors. The proxy card provides shareholders with four choices (every one, two or three years, or abstain). Proxies submitted without direction pursuant to this solicitation will be voted for the approval of holding the advisory vote on executive compensation once every “three years.”

RECOMMENDATION OF THE BOARD OF DIRECTORS

The Board of Directors unanimously recommends a vote for every “three years” for Proposal No. 3.

The Audit Committee has appointed the firm of BDO USA, LLP (“BDO”), as the Company’s principal independent registered public accounting firm, to audit the accounts and certify the financial statements of the Company for the fiscal year ending November 30, 2013. The appointment shall continue at the pleasure of the Audit Committee. The Company is submitting the selection of BDO to its shareholders for ratification as a matter of good corporate governance. If the appointment is not ratified by the shareholders of the Company, the Audit Committee may reconsider the selection of BDO as the Company's independent registered public accounting firm. Even if the selection is ratified, the Audit Committee may, in its discretion, direct the appointment of a different independent registered public accounting firm at any time it determines that a change would be in the best interests of the Company and our shareholders. BDO has acted as the Company’s auditors commencing with the review of the first quarter of fiscal 2012.

On March 7, 2012, the Company engaged BDO as the Company's principal independent registered public accounting firm to audit its financial statements, replacing KGS LLP (“KGS”) as the Company's independent registered public accounting firm, who were dismissed on the same day. The change was approved by the Audit Committee.

The Company had not consulted with BDO during the two fiscal years ended November 30, 2011 and November 30, 2010 and the subsequent interim period through March 7, 2012, regarding (i) the application of accounting principles to a specified transaction either completed or proposed or the type of audit opinion that might be rendered on the Company's consolidated financial statements, and neither a written report was provided to the Company nor oral advice was provided that BDO concluded was an important factor considered by the Company in reaching a decision as to the accounting, auditing or financial reporting issue; or (ii) any matter that was either the subject of a “disagreement,” as that term is defined in Item 304(a)(1)(iv) of Regulation S-K and the related instructions to Item 304 of Regulation S-K, or a “reportable event,” as that term is defined in Item 304(a)(1)(v) of Regulation S-K.

KGS's report on the Company's financial statements as of and for the fiscal years ended November 30, 2010 and 2011 did not contain any adverse opinion or disclaimer of opinion and was not qualified or modified as to uncertainty, audit scope or accounting principles.

During the Company's fiscal years ended November 30, 2010, and November 30, 2011 and the subsequent interim period through March 7, 2012, there were (i) no disagreements between the Company and KGS on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure, which, if not resolved to the satisfaction of KGS would have caused KGS to make reference thereto in their reports on the financial statements for such years, and (ii) no “reportable events” as that term is defined in Item 304(a)(1)(v) of Regulation S-K.

The Company provided KGS with a copy of the Form 8-K disclosing the above matters, which was filed on March 7, 2012. KGS furnished the Company with a letter addressed to the SEC stating that KGS agreed with the statements made in the Form 8-K regarding KGS. A copy of such letter, dated March 7, 2012, was filed as Exhibit 16.01 to the Form 8-K.

The Board of Directors expects that one or more representatives of BDO will be present at the meeting. Representatives of BDO will then be given the opportunity to make a statement, and will be available to respond to appropriate questions.

The ratification of the Board’s selection of BDO USA, LLP requires the affirmative vote of a majority of the Company's outstanding shares present in person or by proxy and entitled to vote, provided a quorum is present at the Annual Meeting. Abstentions will be counted for the purpose of meeting the quorum requirements and will have the same effect as a vote against the ratification of the Board’s selection of BDO USA, LLP. Broker non-votes will have no effect on the outcome of the proposal.

RECOMMENDATION OF THE BOARD OF DIRECTORS

The Board of Directors unanimously recommends a vote in favor of Proposal No. 4.

SERVICES PROVIDED BY THE AUDITOR AND FEES PAID

Audit Committee Pre-Approval of Services

The Audit Committee pre-approved all audit and non-audit services provided to the Company in fiscal 2012 and 2011 by BDO and KGS, respectively. Under its charter, the Audit Committee must pre-approve all subsequent engagements of our independent registered public accounting firm unless an exception to such pre-approval exists under the Securities Exchange Act of 1934 or the rules of the SEC. Each year, before a independent registered public accounting firm is retained to audit our financial statements, such service and the associated fee, is approved by the Committee. At the beginning of the fiscal year, the Audit Committee evaluates other known potential engagements of the independent registered public accounting firm, including the scope of the work proposed to be performed and the proposed fees, and approves or rejects each service, taking into account whether the services are permissible under applicable law and the possible impact of each non-audit service on the independent registered public accounting firm’s independence from management. At each subsequent Committee meeting, the Committee receives updates on the services actually provided by the independent registered public accounting firm, and management may present additional services for approval. The Committee has delegated to the Chairman of the Committee the authority to evaluate and approve engagements on behalf of the Committee in the event that a need arises for pre-approval between Committee meetings. If the Chairman so approves any such engagements, he will report that approval to the full Audit Committee at its next meeting.

Audit Fees

BDO served as the Company’s independent registered public accounting firm for 2012. KGS served as the Company’s independent registered public accounting firm for 2011. The services performed by both BDO and KGS in this capacity included conducting an audit in accordance with generally accepted audit standards of, and expressing an opinion on, the Company’s consolidated financial statements.

BDO’s fees for professional services rendered in connection with the audit and review of Forms 10-K and all other SEC regulatory filings were $175,000 for the 2012 fiscal year. The Company has paid and is current on all billed fees.

Audit-Related Fees

There were no audit-related fees billed in fiscal 2012.

Tax Fees

Professional services rendered in connection with Federal and State tax return preparation and other tax matters for the 2012 fiscal year were $45,000.

All Other Fees

There were no other fees billed in fiscal years 2012.

The Audit Committee of the Board operates under its charter, which was originally adopted by the Board in 2000. Management is responsible for the Company’s internal accounting and financial controls, the financial reporting process, the internal audit function and compliance with the Company’s policies and legal requirements. The Company’s independent registered public accountants are responsible for performing an independent audit of the Company’s consolidated financial statements in accordance with standards of the Public Company Accounting Oversight Board (United States) and for issuance of a report thereon; they also perform limited reviews of the Company’s unaudited quarterly financial statements.

The Audit Committee’s responsibility is to engage the independent registered public accountants, monitor and oversee these accounting, financial and audit processes and report its findings to the full Board. It also investigates matters related to the Company’s financial statements and controls as it deems appropriate. In the performance of these oversight functions, the members of the Audit Committee rely upon the information, opinions, reports and statements presented to them by Company management and by the independent registered public accountants, as well as by other experts that the Committee hires.

The Committee reviewed and discussed the audited consolidated financial statements of the Company for fiscal year 2012 with management, who represented that the Company’s consolidated financial statements for fiscal 2012 were prepared in accordance with U.S. generally accepted accounting principles. It discussed with BDO USA, LLP ("BDO"), the Company’s independent registered public accountants for fiscal 2012, those matters required to be reviewed pursuant to Statement of Accounting Standards No. 61 (Communication with Audit Committees), as amended by Statement of Accounting Standards No. 90 (Audit Committee Communications). The Committee has received from BDO written independence disclosures and the letter required by applicable requirements of the Public Company Accounting Oversight Board regarding BDO’s communications with the Audit Committee concerning independence and discussed with BDO its independence.

Based on the review of the representations of management, the discussions with management and the independent registered public accountants and the review of the Report of BDO USA, LLP, Independent Registered Public Accounting Firm for fiscal 2012, to the Committee, the Audit Committee recommended to the Board that the financial statements of the Company for fiscal year 2012 as audited by BDO be included in the Company’s Annual Report on Form 10-K filed with the Securities and Exchange Commission.

|

|

AUDIT COMMITTEE |

Robert Lage (Chairman) |

Sardar Biglari |

Philip L. Cooley |

Stanley Kreitman |

Jonathan Rothschild |

_____________________________

|

| |

* | The information contained in this Audit Committee Report shall not be deemed to be “soliciting material” or to be “filed” with the SEC, nor shall such information be incorporated by reference into any filings under the Securities Act of 1933, as amended, or under the Securities Exchange Act of 1934, as amended, except to the extent that we specifically incorporate this information by reference into any such filing. |

Other Matters

The Board of Directors knows of no other matters to be presented, but if any other matters properly come before the Annual Meeting, it is intended that the persons holding proxies will vote thereon in accordance with their best judgments.

When a shareholder votes over the telephone, internet or returns a duly executed proxy, the shares represented thereby will be voted as indicated thereon or, if no direction is indicated, in accordance with the recommendations of the Board of Directors.

Solicitation of Proxies

The Company will bear the entire cost of solicitation, including preparation, assembly, printing and mailing of this Proxy Statement, the proxy, and any additional material furnished. The proxy materials will be furnished to brokerage houses, fiduciaries, and custodians holding shares in their names that are beneficially owned by others, for forwarding of such material to beneficial owners. The Company may reimburse such persons their forwarding costs. Original solicitation of proxies by mail may be supplemented by telephone, email, fax, or personal solicitation by directors, officers or employees of the Company. No additional compensation will be paid for any such services.

Shareholder Proposals for the Year 2014

Under SEC proxy rules, if a shareholder wants the Company to include a proposal in its proxy statement and proxy card for the 2014 Annual Meeting of Shareholders, the proposal must be received by the Company no later than February 7, 2014.